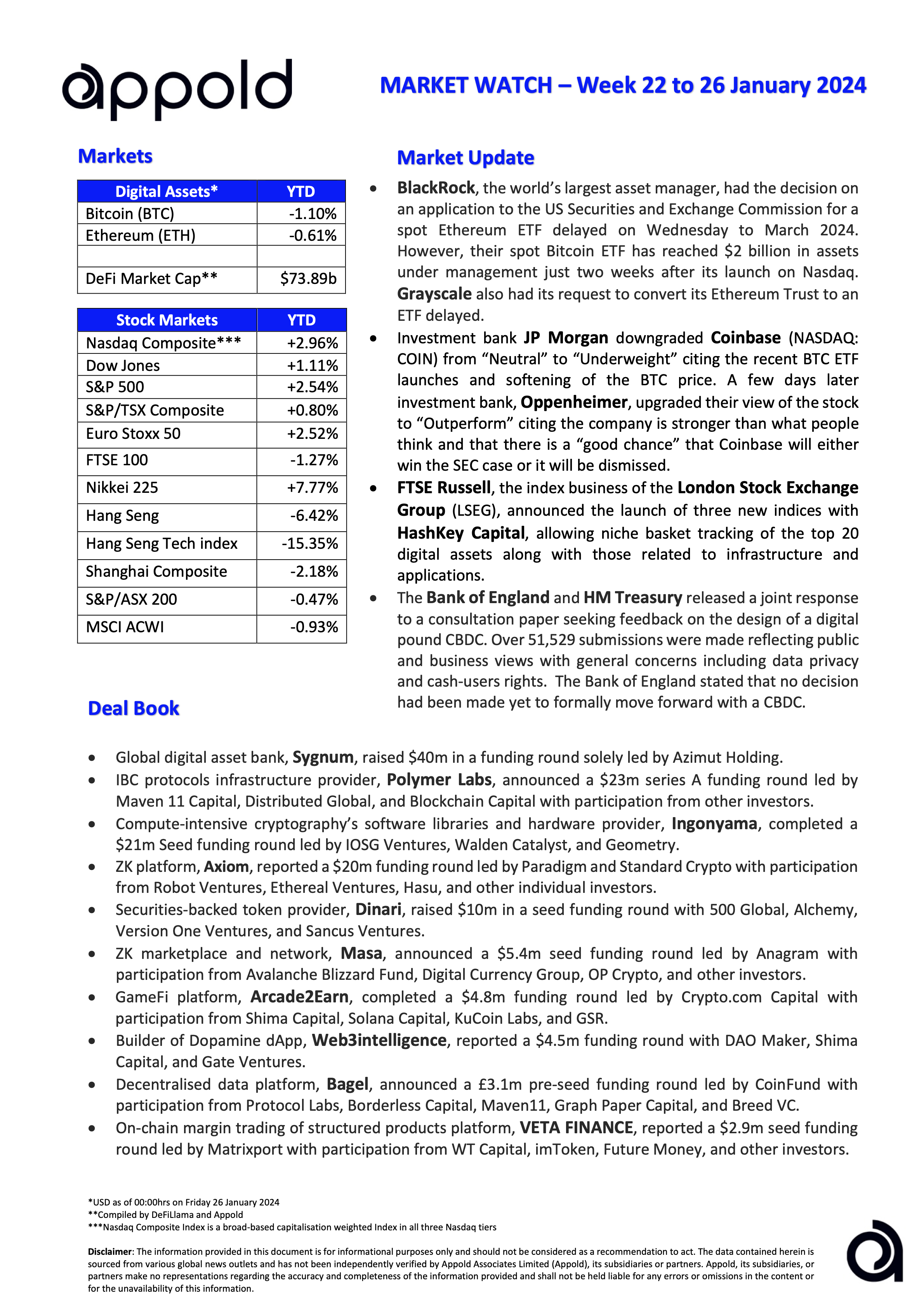

Appold Market Watch - Week 22 to 26 January 2024

Market Update & Industry News - Week ending 26 January 2024

🔷 BlackRock, the world’s largest asset manager, had the decision on an application to the U.S. Securities and Exchange Commission for a spot Ethereum ETF delayed on Wednesday to March 2024. However, their spot Bitcoin ETF has reached $2 billion in assets under management just two weeks after its launch on Nasdaq. Grayscale Investments also had its request to convert its Ethereum Trust to an ETF delayed.

Appold view: The AUM is creeping up, whilst in Europe the fee war has begun with Invesco Ltd. and WisdomTree slashing their physical BTC ETP products by over 60%.

🔷 Investment bank J.P. Morgan downgraded Coinbase (NASDAQ: COIN) from “Neutral” to “Underweight” citing the recent BTC ETF launches and softening of the BTC price. A few days later, investment bank Oppenheimer & Co. Inc. upgraded their view of the stock to “Outperform”, citing that the company is stronger than what people think and that there is a “good chance” that Coinbase will either win the SEC case or it will be dismissed.

Appold view: This just highlights the risk of these stocks. The launch of the spot ETFs in the US could certainly diminish some volumes on the exchange, although ETFs don’t offer 24-hour trading. But Coinbase is diversified with a strong custodian business, of which Blackrock is a client and currently holds its ETF positions. Disputes with the local regulators are certainly a key risk factor for the company.

🔷 FTSE Russell, An LSEG Business, the index business of the London Stock Exchange Group (LSEG), announced the launch of three new indices with HashKey Capital, allowing niche basket tracking of the top 20 digital assets along with those related to infrastructure and applications.

Appold view: FTSE is expanding its index offering in this sector as index providers compete for business and profile as digital assets become increasingly mainstream from institutional adoption. The underlying constituents of these indices must trade on “Hong Kong” exchanges, which implies a very Asia-centric and niche offering.

🔷 The Bank of England and HM Treasury released a joint response to a consultation paper seeking feedback on the design of a digital pound CBDC. Over 51,529 submissions were made reflecting public and business views with general concerns including data privacy and cash-users rights. The Bank of England stated that no decision had been made yet to formally move forward with a CBDC.

Appold view: The takeaway point in the statement is, as expected, that no final decision has been made to pursue a digital pound but work will continue. We will look to publish some notes on this later in the week.