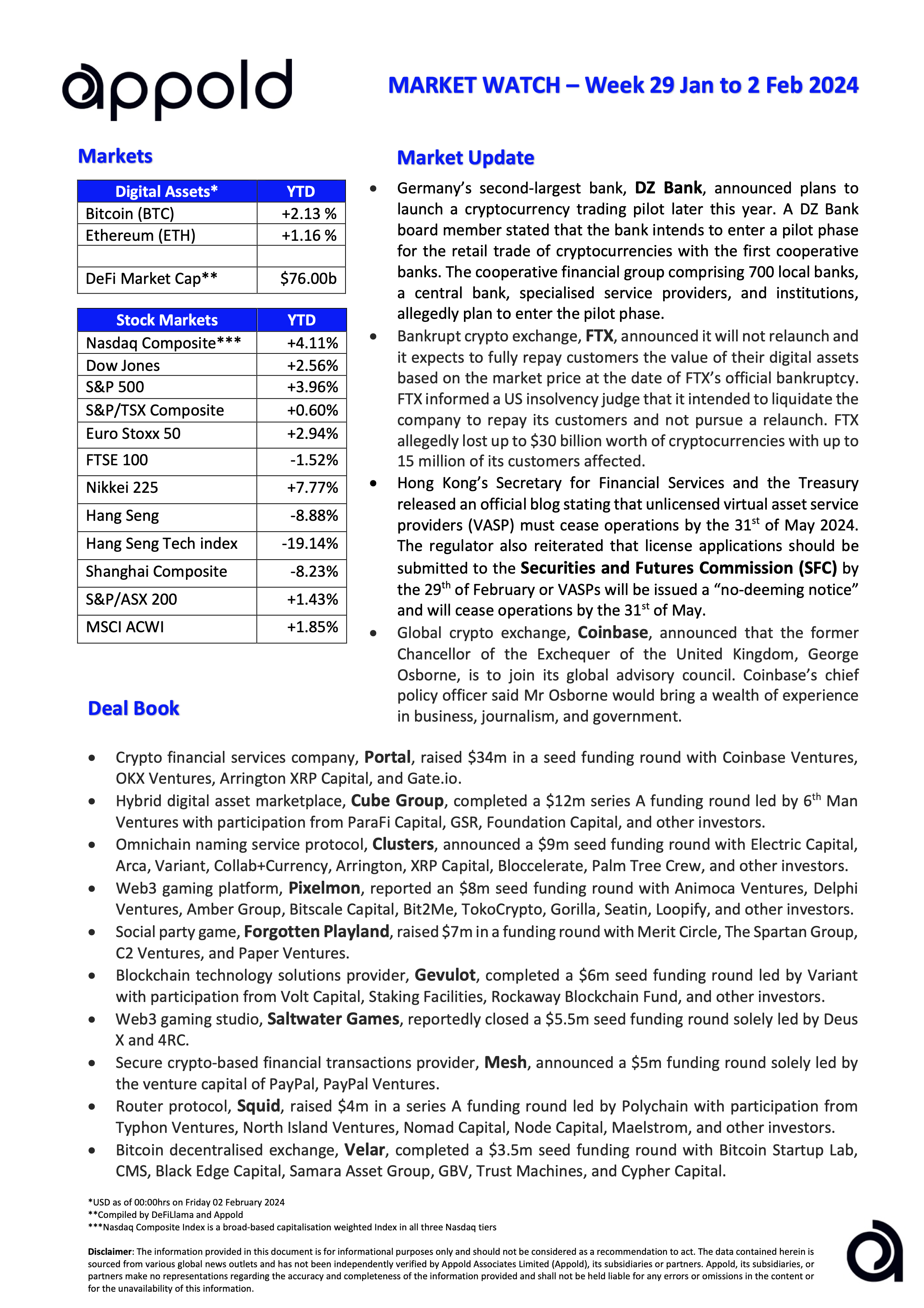

Appold Market Watch - Week 29 January to 2 February 2024

Market Update & Industry News - Week ending 2 February 2023

🔷 Germany’s second-largest bank, DZ BANK AG, announced plans to launch a cryptocurrency trading pilot later this year. A DZ Bank board member stated that the bank intends to enter a pilot phase for the retail trade of cryptocurrencies with the first cooperative banks. The cooperative financial group comprising 700 local banks, a central bank, specialised service providers, and institutions, plan to enter the pilot phase.

Appold view: Interesting to see DZ Bank target the retail market on such a scale. Many competitors and interested parties will observe which partners they use for areas such as liquidity provision and custody, or whether they can internalise the client flow and manage key functions in-house.

🔷 It was widely reported that bankrupt crypto exchange, FTX, announced it will not relaunch and it expects to fully repay customers the value of their digital assets based on the market price at the date of FTX’s official bankruptcy. FTX informed a US insolvency judge that it intended to liquidate the company to repay its customers and not pursue a relaunch. FTX allegedly lost up to $30 billion worth of cryptocurrencies with up to 15 million of its customers affected.

Appold view: A commendable statement mentioning full repayment to clients and creditors but the devil is in the detail with lots of variables. The lawyers representing the estate said that they could “cautiously predict” a full repayment to the customers and creditors. However, it was “an objective” and not a “guarantee.”

🔷 Hong Kong's Secretary for Financial Services and the Treasury released an official blog stating that unlicensed virtual asset service providers (VASP) must cease operations by the 31st of May 2024. The regulator also reiterated that license applications should be submitted to the Securities and Futures Commission (SFC) by the 29th of February or VASPs will be issued a “no-deeming notice” and will cease operations by the 31st of May.

Appold view: A welcome step in better regulating the industry within the region and working towards a framework that enhances stability, transparency and security of asset transactions.

🔷 Global crypto exchange, Coinbase, announced that the former Chancellor of the Exchequer of the United Kingdom, George Osborne, is to join its global advisory council. Coinbase’s chief policy officer said Mr Osborne would bring a wealth of experience in business, journalism and government.

Appold view: Bringing in former politicians as advisors is usually an advocacy and strategic connections play as we have seen many times in the industry with mixed results. We meet many Parliamentarians who are keen to be associated with the industry but it’s reasonable to say that many of those don’t understand the market, but arguably that is not always a necessity.

#marketwatch #blockchain #investments