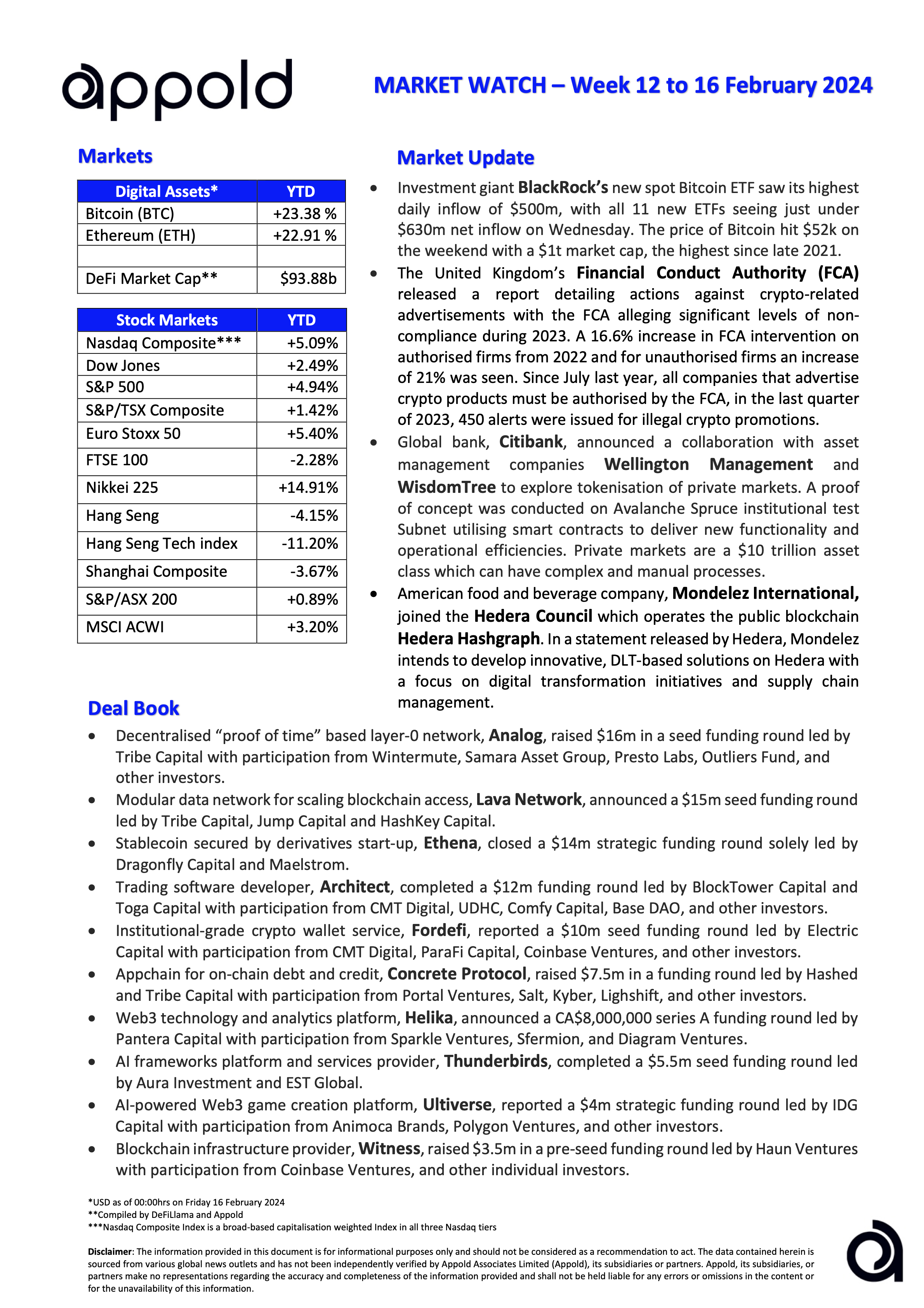

Appold Market Watch - Week 12 to 16 February 2024

Market Update & Industry News - Week ending 16 February 2024

🔷 Investment giant BlackRock’s new spot Bitcoin ETF saw its highest daily inflow of $500m, with all 11 new ETFs seeing just under $630m net inflow on Wednesday. The price of Bitcoin hit $52k on the weekend with a $1t market cap, the highest since late 2021.

Appold view: This certainly enforces the increasing confidence in the asset class, and with Bitcoin halving around two months away, we would not be surprised to see these holdings continue to increase.

🔷 The United Kingdom’s Financial Conduct Authority (FCA) released a report detailing actions against crypto-related advertisements with the FCA alleging significant levels of non-compliance during 2023. A 16.6% increase in FCA intervention on authorised firms from 2022 and for unauthorised firms an increase of 21% was seen. Since July last year, all companies that advertise crypto products must be authorised by the FCA, in the last quarter of 2023, 450 alerts were issued for illegal crypto promotions.

Appold view: It is good to see the policy taking effect and enforcement orders being issued. Protecting consumers is paramount, and the actions to remove bad actors from this sector help improve integrity. More policies to come.

🔷 Global bank, Citi, announced a collaboration with asset management companies Wellington Management and WisdomTree to explore tokenisation of private markets. A proof of concept was conducted on Avalanche Spruce institutional test Subnet utilising smart contracts to deliver new functionality and operational efficiencies. Private markets are a $10 trillion asset class that can have complex and manual processes.

Appold view: Appold reported this on LinkedIn last week and further details can be found there. In short, utilising smart contracts enables rule-enforcement and more efficient workflows to these traditionally complex and less commoditised private markets. This is a significant opportunity to scale this asset class efficiently.

🔷 American food and beverage company, Mondelēz International, joined the Hedera Council which operates the public blockchain Hedera Hashgraph. In a statement released by Hedera, Mondelez intends to develop innovative, DLT-based solutions on Hedera with a focus on digital transformation initiatives and supply chain management.

Appold view: Mondelez joins other commercial enterprises working with Hedera on blockchain efficiencies. These include Boeing, Google, IBM, Standard Bank Group, DLA Piper, EDF and Deutsche Telekom.