Appold Market Watch - Week 18 to 22 March 2024

Market Update & Industry News - Week ending 22 March 2024

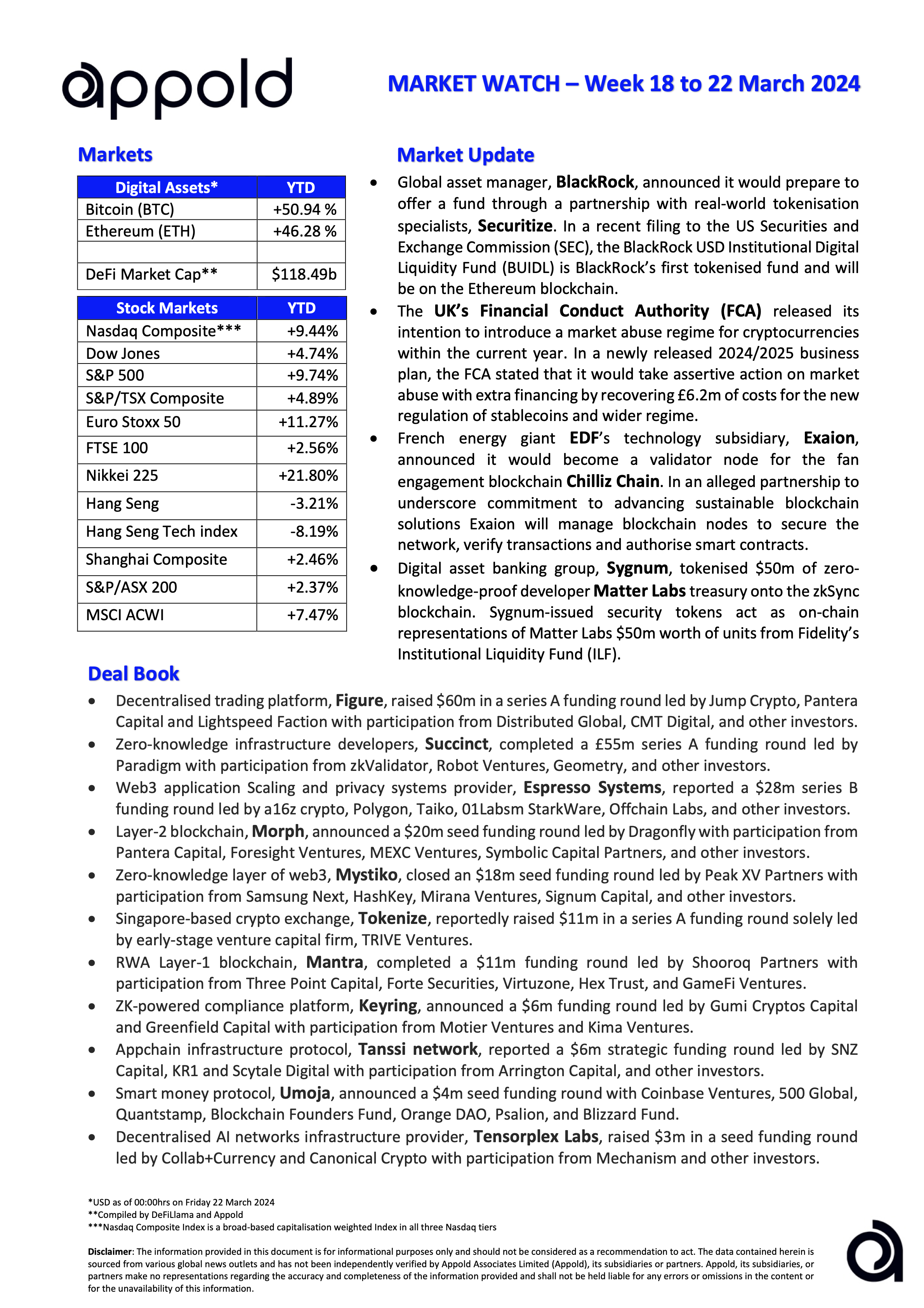

🔷 Global asset manager, BlackRock, announced it would prepare to offer a fund through a partnership with real-world tokenisation specialists, Securitize. In a recent filing to the U.S. Securities and Exchange Commission (SEC), the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) is BlackRock’s first tokenised fund and will be on the Ethereum blockchain.

Appold view: There is no doubt that tokenisation will transform capital markets and BlackRock appears to be scaling its strategy in this area. The fund will reportedly invest in cash, treasury bills and repurchase agreements. Investors will receive tokens for their initial investment with yields then being paid in token form to their digital wallets.

🔷 UK’s Financial Conduct Authority (FCA) released its intention to introduce a market abuse regime for cryptocurrencies within the current year. In a newly released 2024/2025 business plan, the FCA stated that it would take assertive action on market abuse with extra financing by recovering £6.2m of costs for the new regulation of stablecoins and wider regime

Appold view: This initiative reflects a growing recognition of the need for regulatory frameworks in this growing industry.

🔷 French energy giant EDF’s technology subsidiary, Exaion, announced it would become a validator node for the fan engagement blockchain Chilliz Chain. In an alleged partnership to underscore commitment to advancing sustainable blockchain solutions Exaion will manage blockchain nodes to secure the network, verify transactions and authorise smart contracts

Appold view: An interesting development in helping a blockchain known for its focus on fan engagement into the sports and entertainment industry. It will be interesting to see how this develops.

🔷 Digital asset banking group, Sygnum Bank, tokenised $50m of zero-knowledge-proof developer Matter Labs treasury onto the zkSync blockchain. Sygnum-issued security tokens act as on-chain representations of Matter Labs $50m worth of units from Fidelity’s Institutional Liquidity Fund (ILF).

Appold view: It is great to see increased uses of this technology. zkSync uses Zero-knowledge-Rollups (ZK-Rollups) which bundles hundreds of transactions into a single transaction which is then validated, known as zero-knowledge proof. This allows increased transactions on the Ethereum network, increasing scalability and security.

#Marketwatch #Blockchain #Investments