Appold Market Watch - Week ending 25 July 2025

Market Update & Industry News - Week ending 25 July 2025

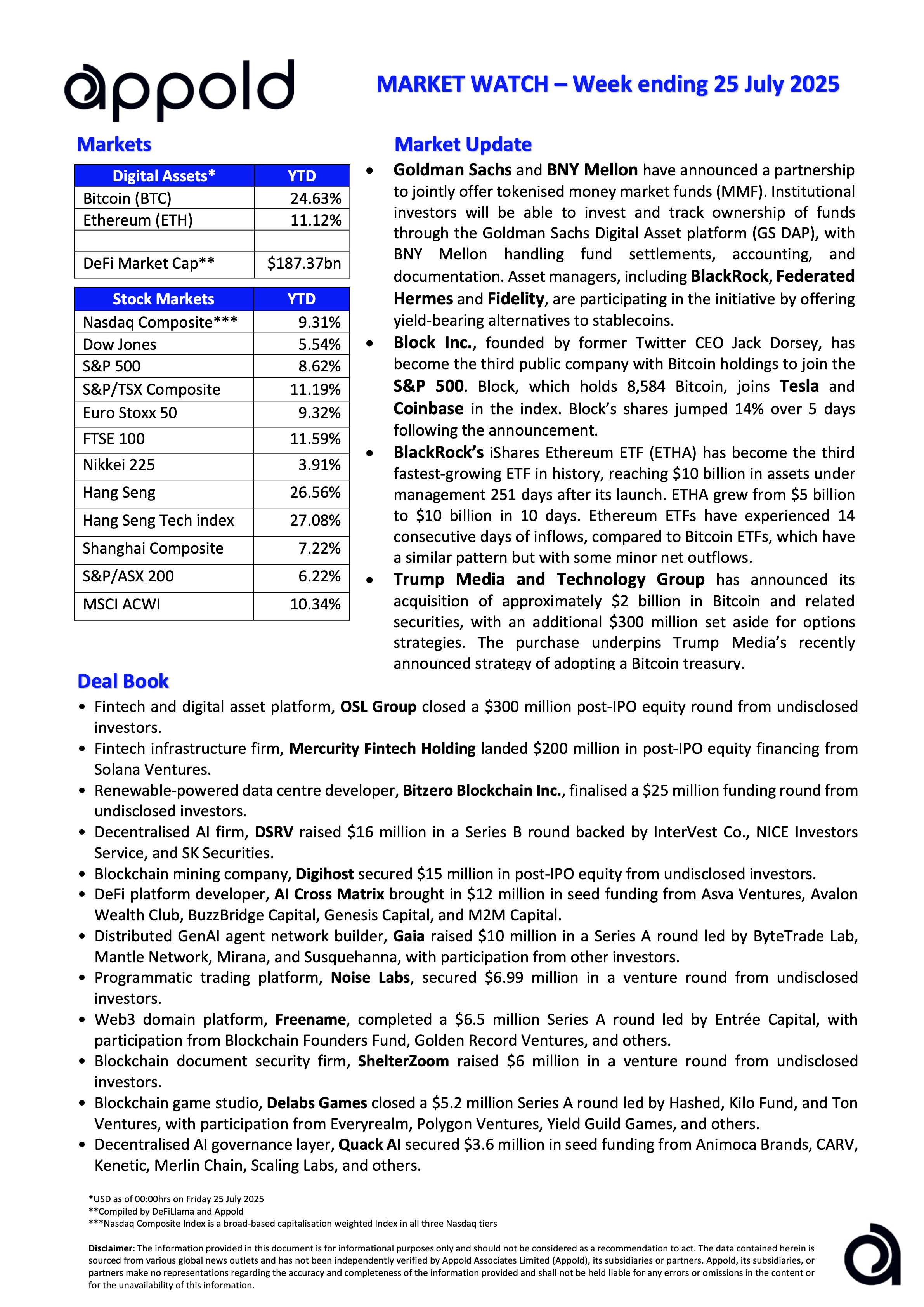

🔷 Goldman Sachs and BNY Mellon have announced a partnership to jointly offer tokenised money market funds (MMF). Institutional investors will be able to invest and track ownership of funds through the Goldman Sachs Digital Asset platform (GS DAP), with BNY Mellon handling fund settlements, accounting, and documentation. Asset managers, including BlackRock, Federated Hermes and Fidelity Investments, are participating in the initiative by offering yield-bearing alternatives to stablecoins.

Appold view: Tokenised MMFs essentially offer the same benefits as traditional MMFs but with added advantages such as 24 hour access and increased transparency. Although demand hasn’t been strong to date, interest is growing and these improved fund distribution channels can heighten interest and force other institutions to follow suit with similar offerings.

🔷 Block Inc., founded by former Twitter CEO Jack Dorsey, has become the third public company with Bitcoin holdings to join the S&P 500. Block, which holds 8,584 Bitcoin, joins Tesla and Coinbase in the index. Block’s shares jumped 14% over 5 days following the announcement.

Appold view: Block’s inclusion in the S&P 500 reinforces Bitcoin’s growing legitimacy within public markets and signals institutional investors are increasingly comfortable with digital asset exposure.

🔷 BlackRock’s iShares Ethereum ETF (ETHA) has become the third fastest-growing ETF in history, reaching $10 billion in assets under management 251 days after its launch. ETHA grew from $5 billion to $10 billion in 10 days. Ethereum ETFs have experienced 14 consecutive days of inflows, compared to Bitcoin ETFs, which have a similar pattern but with some minor net outflows.

Appold view: ETHA’s rapid ascent highlights growing investor confidence in Ethereum-based products as well as ongoing portfolio diversification as investors seek to remain exposed to the digital asset sector.

🔷 Trump Media & Technology Group has announced its acquisition of approximately $2 billion in Bitcoin and related securities, with an additional $300 million set aside for options strategies. The purchase underpins Trump Media’s recently announced strategy of adopting a Bitcoin treasury.

Appold view: This significant allocation doubles down on the current Bitcoin corporate-treasury trend. However, this level of exposure raises concerns over risk management and balance sheet concentration for a company still establishing operational maturity.

#Marketwatch #Blockchain #Investments