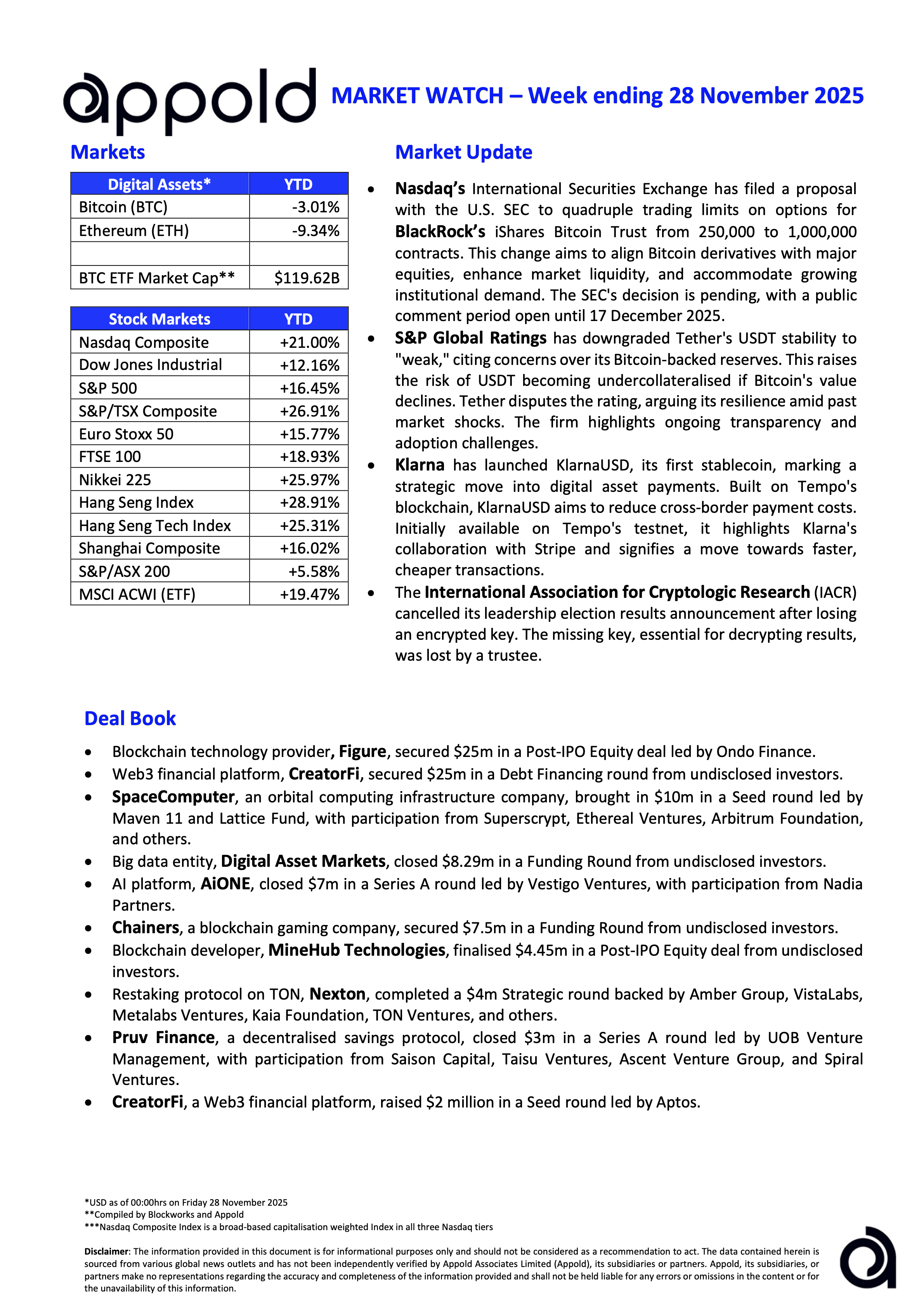

Appold Market Watch - Week ending 28 November 2025

Market Update & Industry News - Week ending 28 November 2025

🔷 Nasdaq’s International Securities Exchange has filed a proposal with the U.S. SEC to quadruple trading limits on options for BlackRock’s iShares Bitcoin Trust from 250,000 to 1,000,000 contracts. This change aims to align Bitcoin derivatives with major equities, enhance market liquidity, and accommodate growing institutional demand. The SEC's decision is pending, with a public comment period open until 17 December 2025.

Appold's View: From 25k to 250k contracts in August, and now this latest request to 1million, Nasdaq is arguing that the current cap is restricting large institutions and market-makers by limiting hedging and risk management. The trajectory is clear; even during a tough period for Bitcoin prices, institutional demand is growing, highlighting a strong desire from institutions to access larger volumes of Bitcoin exposure.

🔷 S&P Global Ratings has downgraded Tether.io's USDT stability to "weak," citing concerns over its Bitcoin-backed reserves. This raises the risk of USDT becoming undercollateralised if Bitcoin's value declines. Tether disputes the rating, arguing its resilience amid past market shocks. The firm highlights ongoing transparency and adoption challenges.

Appold’s View: Tether’s downgrade reflects more than its Bitcoin reserves. S&P Global cited limited transparency around custodians, counterparties and banking partners. While some view this as the establishment pushing back against Tether, it underscores a broader point: strong governance, transparency and accountability frameworks are now essential for any company seeking institutional credibility. As blockchain firms mature, they will increasingly be held to these standards.

🔷 Klarna has launched KlarnaUSD, its first stablecoin, marking a strategic move into digital asset payments. Built on Tempo's blockchain, KlarnaUSD aims to reduce cross-border payment costs. Initially available on Tempo's testnet, it highlights Klarna's collaboration with Stripe and signifies a move towards faster, cheaper transactions.

Appold’s View: Why shouldn’t any neo-finance platform attempt to issue a stablecoin? Although it may appear an unusual pivot, the use cases and revenue potential are enormous. Any platform with a large user base has a meaningful opportunity to gain traction. With Bridge’s new Open Issuance platform, even more companies are likely to enter the market. It will be interesting to see how interoperability evolves as this landscape becomes increasingly crowded.

🔷 The International Association for Cryptologic Research (IACR) cancelled its leadership election results announcement after losing an encrypted key. The missing key, essential for decrypting results, was lost by a trustee.

Appold’s View: That caused a few rolled eyes across the industry. Probably best they call Appold in to sharpen up their operational resilience procedures.

#Marketwatch #Blockchain #Investments