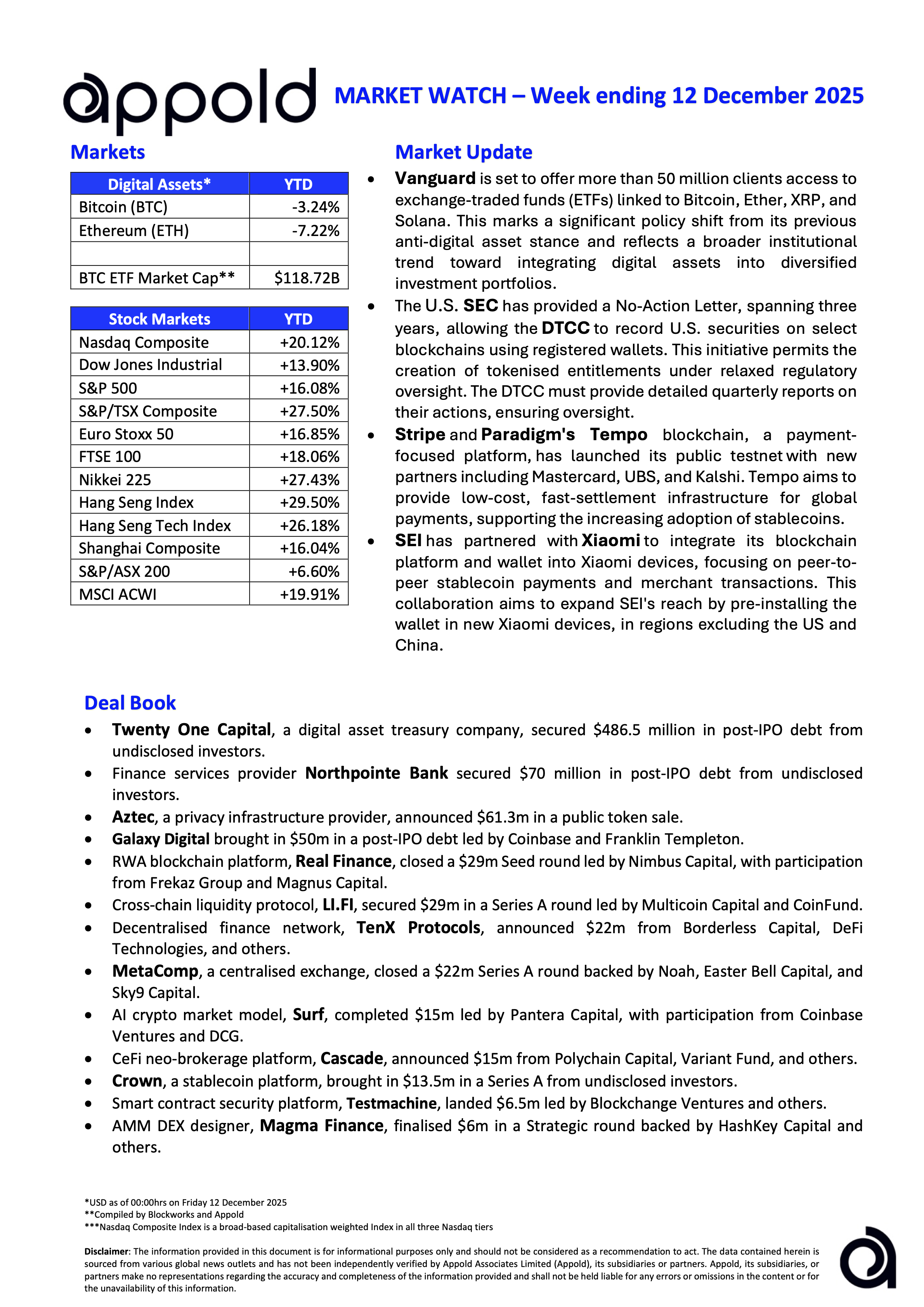

Appold Market Watch - Week ending 12 December 2025

Market Update & Industry News - Week ending 12 December 2025

🔷 Vanguard is set to offer its 50m client base access to exchange-traded funds (ETFs) linked to Bitcoin, Ether, XRP, and Solana. This appears to be a significant policy shift from its previous stance against digital assets and highlights the broader institutional trend toward integrating digital assets into diversified investment portfolios.

Appold’s View: While Vanguard has demonstrated its stance by excluding memecoin ETFs, the broader direction is unmistakable: access to digital assets is moving in the direction of portfolio necessity. Regardless of individual companies' views on the asset class, incumbent financial institutions can't ignore its continued growth. Failing to offer at least some level of exposure risks eroding relevance and client expectations as investors' demands evolve.

🔷 The U.S. SEC has provided a No-Action Letter, spanning three years, allowing the DTCC to record U.S. securities on blockchains using registered wallets. This initiative permits the creation of tokenised entitlements under relaxed regulatory oversight. The DTCC must provide detailed quarterly reports on their actions, ensuring oversight.

Appold’s View: This move appears to provide the SEC with a valuable opportunity to closely observe real-world blockchain applications. It is also a positive signal for DeFi, as the tokenisation of traditional assets could, over time, create precedents and greater interoperability between legacy financial infrastructure and on-chain markets.

🔷 Stripe and Paradigm's Tempo blockchain, a payment-focused platform, has launched its public testnet with new partners including Mastercard, UBS, and Kalshi. Tempo aims to provide low-cost, fast-settlement infrastructure for global payments, supporting the increasing adoption of stablecoins.

Appold’s View: Competition for dominance in stablecoin payment rails continues to intensify. Stripe’s announcement is a meaningful step forward, with integrated products now spanning stablecoin issuance and network infrastructure. However, it will be interesting to see how Stripe’s network performs in the long term, particularly under increased congestion.

🔷 SEI has partnered with Xiaomi Technology to integrate its blockchain platform and wallet into Xiaomi devices, focusing on peer-to-peer stablecoin payments and merchant transactions. This collaboration aims to expand SEI's reach by pre-installing the wallet in new Xiaomi devices, in regions excluding the US and China.

Appold’s View: For a relatively small blockchain project like Sei, this news is a significant win, as it will materially expand its potential user base and incentivise developer integration. It will be interesting to see the commercial terms behind this arrangement and how much Sei has paid to secure this privilege.

#Marketwatch #Blockchain #Investments