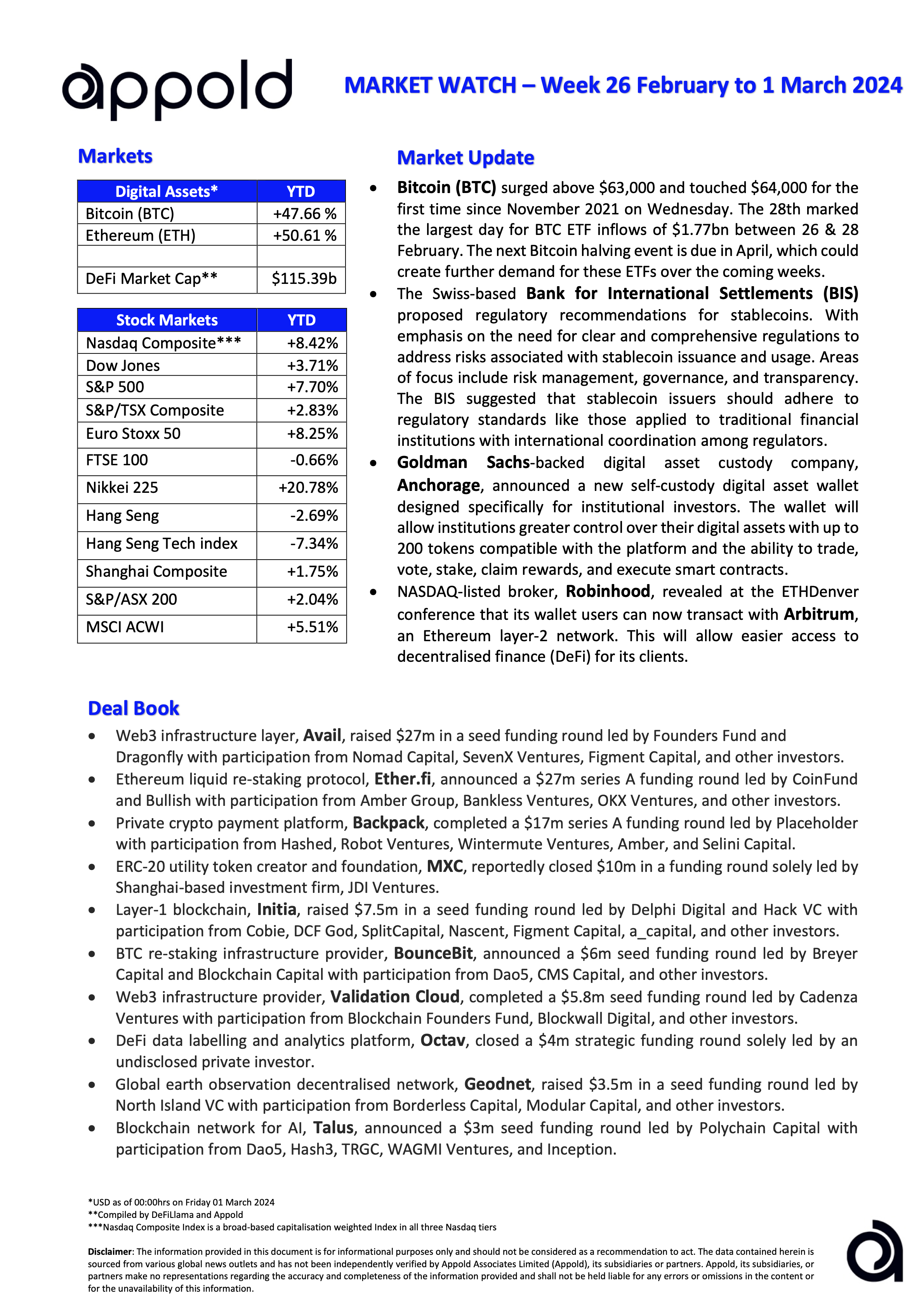

Appold Market Watch - Week 26 February to 1 March 2024

Market Update & Industry News - Week ending 1 March 2024

🔷 (BTC) surged above $63,000 and touched $64,000 for the first time since November 2021 on Wednesday. The 28th marked the largest day for BTC ETF inflows, with net inflows of $1.77bn between 26 and 28 February. The next Bitcoin halving event is due in April, which could create further demand for these ETFs over the coming weeks.

Appold view: The increased access for institutional investors will have certainly contributed to this. The access and distribution continues to expand, Bank of America Merrill Lynch and Wells Fargo have announced that they will begin to allow spot BTC ETF to clients on their brokerage platforms.

🔷 The Swiss-based Bank for International Settlements – BIS proposed regulatory recommendations for stablecoins. With emphasis on the need for clear and comprehensive regulations to address risks associated with stablecoin issuance and usage. Areas of focus include risk management, governance, and transparency. The BIS suggested that stablecoin issuers should adhere to regulatory standards like those applied to traditional financial institutions with international coordination among regulators.

Appold view: This reflects a cautious but forward-looking stance on stablecoin integration into the financial system from this central bank membership organisation.

🔷 Goldman Sachs-backed digital asset custody company, Anchorage Digital, announced a new self-custody digital asset wallet designed specifically for institutional investors. The wallet will allow institutions greater control over their digital assets with up to 200 tokens compatible with the platform and the ability to trade, vote, stake, claim rewards, and execute smart contracts.

Appold view: The increase in competition to offer institutional self-custody is growing as demand starts to increase. We understand that more announcements are in the pipeline from other competitors driven by greater institutional acceptance of the asset class.

🔷 NASDAQ-listed broker, Robinhood, revealed at the ETHDenver conference that its wallet users can now transact with Arbitrum, an Ethereum layer-2 network. This will allow easier access to decentralised finance (DeFi) for its clients.

Appold view: This blockchain integration into a traditional finance service provider enables broader access to Web3 finance. Arbitrums layer-2 scaling solutions integration into Robinhood’s self-custody wallet will simplify access to DeFi whilst offering faster transaction speeds and lower costs.