The role of stablecoins in enhancing cross-border payments

5 March 2024

Taken from the published LinkedIn pulse article.

Cross-border transactions play a significant role in today's globalised economy, facilitating the transfer of funds across national borders when the registration location of a business, or the issuance site of a payment card, differs between states. With the total value of cross-border payments forecasted by the Bank of England to exceed $250 trillion by 2027, up from $150 trillion in 2017, digital assets and in particular stablecoins are increasingly utilised by firms with cross-border operations as an alternative to the existing, costly and inefficient fiat-based cross-border payments system.

Growth of Stablecoin usage

Stablecoins are digital assets that are tied to the value of a reference asset. The most utilised are fiat-backed, with most of the activity in US Dollar (USD). These are pegged to a 1:1 value ratio with the underlying fiat currency to ensure stability and reliability in their valuation.

It is estimated that the value of payment transactions facilitated by stablecoins will exceed $187 billion globally by 2028, up from $53 billion in 2023. The value of cross-border stablecoin payments is predicted to represent almost 73% of total stablecoin payment transaction values globally by 2028.

The increased use of stablecoins in cross-border transactions derives from their ability to mitigate many of the challenges that fiat currency-based payments face. A 2021 report by the Financial Stability Board, an international body for monitoring and making recommendations for the global financial system, characterised the challenges of fiat-based cross-border currencies into 4 categories:

· High costs due to fee accumulation across the payment chain, such as account fees, transaction fees and applied FX conversion rates and fees.

· Slow settlement times and low speeds in the processing time of end-to-end payments, such as slow processes for funding and defunding, daily cut-off times and closing times.

· Limited access for users in accessing services as well as for payment service providers in accessing payment systems.

· Limited transparency about costs, speed, processing chain, and payment status.

Stablecoins have the potential to reduce costs and mitigate the inefficiencies of these traditional fiat-based processes. These Stablecoins can:

· Reduce transaction fees

· Provide near-term settlement on a 24/7 basis

· Eliminate multiple currency conversions in less traded currencies

· Reduce the impact of shortened FX settlement windows

By utilising blockchain technology, stablecoins can ensure wider accessibility to jurisdictions without the high costs and inefficiencies of using traditional payment services or banking infrastructures in the actual transaction. This allows for control over payments whilst allowing for real-time tracking of transactions and fees.

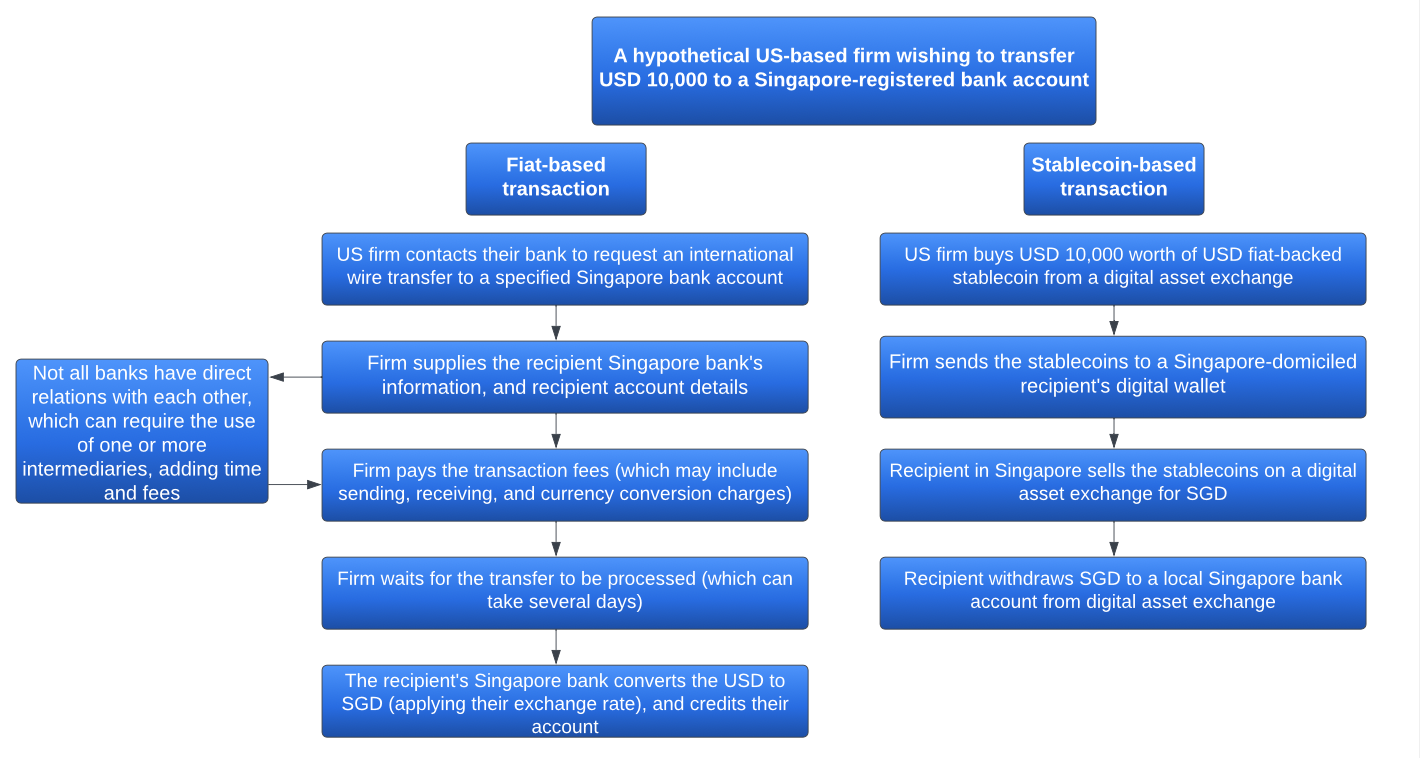

This diagram provides a high-level process overview of a fiat-based cross-border transaction when compared to using stablecoins.

Market Patterns

According to CCData, in January 2024 the spot traded volumes of digital assets were approximately $1.4tn. From our engagements, we estimate that over 65%, most likely more (and growing) of traded volume is non-retail, i.e. Institutional and corporate flow. This accounts for over $910bn in transactions in January alone.

When we break this data down further in terms of stablecoin activity, CCData reports that volume to be around $1.04tn in January, which would equate to over $650bn in non-retail activity. This volume excludes non-publicly accessible digital assets, such as JP Morgan’s own stablecoin (JPM Coin) which is reportedly transacting over $1bn a day in client activity.

Charles Hayter, CEO of CCData stated “Our data represents that the Stablecoin activity continues to grow. Tether (UST) remains the most dominant and actively traded Stablecoin with approximately 70% of the stablecoin market share, with Circle (USDC) losing market share in 2023. We expect volumes in Stablecoins to continue to grow and this data can be viewed in our monthly market reports.”

Concluding Insights

Given the benefits, it is unsurprising that institutional adoption of stablecoins and digital assets for cross-border transactions has already begun, with a 2021 report by PYMNTS finding that 84% of respondent businesses that operated in more than 10 countries utilised digital asset solutions including stablecoins, as did 70% of those operating in six to 10 countries. Furthermore, in 2023, one of Australia's largest banking firms, National Australia Bank, tested foreign exchange transfers using the Ethereum blockchain and its own Australian dollar-pegged stablecoin, AUDN.

Despite their utility, however, the use of stablecoins in cross-border transactions much like the wider digital assets ecosystem, has faced the challenge of a lack of regulatory clarity to greater institutional adoption. However, in a promising development, a December 2023 report by PWC found that of 43 countries, 25 now have stablecoin regulations in place with only 18% having yet to initiate the introduction of stablecoin regulation.

With greater global regulatory clarity on stablecoins, and the inefficiencies of current fiat-based cross-border payment systems being acknowledged by prominent financial entities including the G20, the FSB, and the Bank of England, we will likely continue to see an expanded and growing incorporation of stablecoins into the global cross-border payments transfer system.

As a specialist strategic advisory, Appold’s expertise comes from being at the forefront of the growing and significant digital assets industry. Our deep integration within the digital assets community positions us uniquely to provide in-depth support, guidance, and insights to our clients across the entire spectrum of digital asset utility.

Reach out to us today to explore how we can help you leverage the full potential of digital assets and stablecoins for your business.

For further information, please contact:

info@appold.com