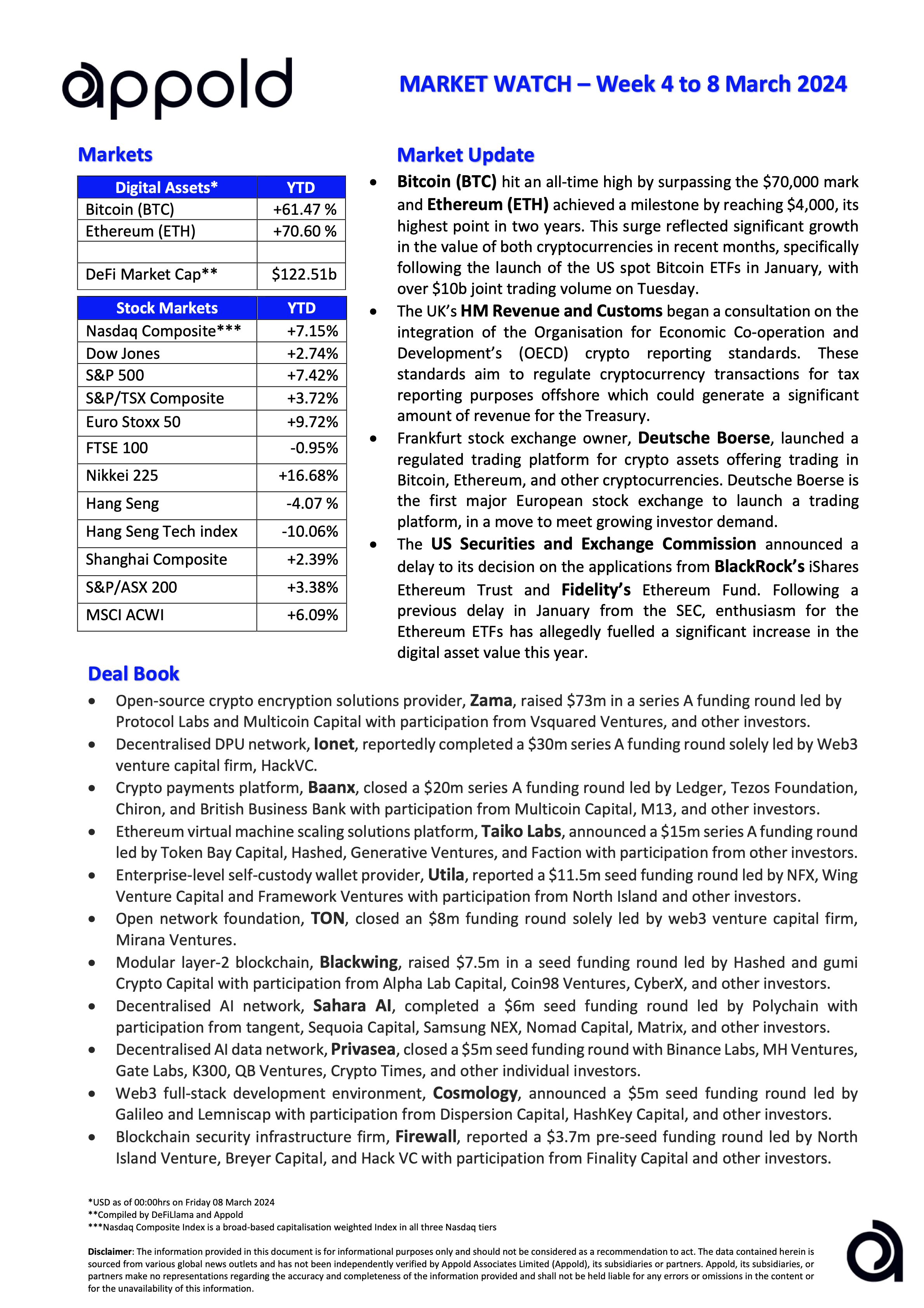

Appold Market Watch - Week 4 to 8 March 2024

Market Update & Industry News - Week ending 8 March 2024

🔷 Bitcoin (BTC) hit an all-time high by surpassing the $70,000 mark and Ethereum (ETH) achieved a milestone by reaching $4,000, its highest point in two years. This surge reflected significant growth in the value of both cryptocurrencies in recent months, specifically following the launch of the US spot Bitcoin ETFs in January, with over $10b joint trading volume on Tuesday.

Appold view: We observe this market cautiously. The BTC halving is weeks away where miners can only “mine” 450 Bitcoins per day from the current 900 Bitcoins. So far, at the current market price, BTC ETF demand appears to be outstripping new supply.

🔷 The UK’s HM Revenue & Customs began a consultation on the integration of the Organisation for Economic Co-operation and Development’s (OECD) crypto reporting standards. These standards aim to regulate cryptocurrency transactions for tax reporting purposes offshore which could generate a significant amount of revenue for the Treasury.

Appold view: Harmonisation on rules across borders helps the industry in terms of transparency. The implementation of OECD standards will lead to a significant increase in revenue, with estimates suggesting that approximately £200 million could be generated from 2026 to 2029 for the UK government.

🔷 German stock exchange operator, Deutsche Börse, launched a regulated trading platform for crypto assets offering trading in Bitcoin, Ethereum, and other cryptocurrencies. Deutsche Börse is the first major European stock exchange to launch a trading platform, in a move to meet growing investor demand.

Appold view: A little late to the party but ahead of its traditional exchange peers. The exchange reportedly invested over $100m in Crypto Finance AG in 2021, taking a majority stake in the company. This company will be the backbone of the settlement and custody piece.

🔷 The U.S. Securities and Exchange Commission announced a delay to its decision on the applications from BlackRock’s iShares Ethereum Trust and Fidelity Investments' Ethereum Fund. Following a previous delay in January from the SEC, enthusiasm for the Ethereum ETFs has fuelled a significant increase in the digital asset value this year.

Appold view: It’s like Groundhog Day but with ETH now instead of BTC. Amongst other complications, the SEC is most likely concerned with the success of the BTC ETFs and is potentially dampening sector growth. ETH prices have been very bullish these past weeks and rumours are that a decision will made by late May.

#Marketwatch #Blockchain #Investments