Appold Market Watch - Week 1 to 5 April 2024

Market Update & Industry News - Week ending 5 April 2024

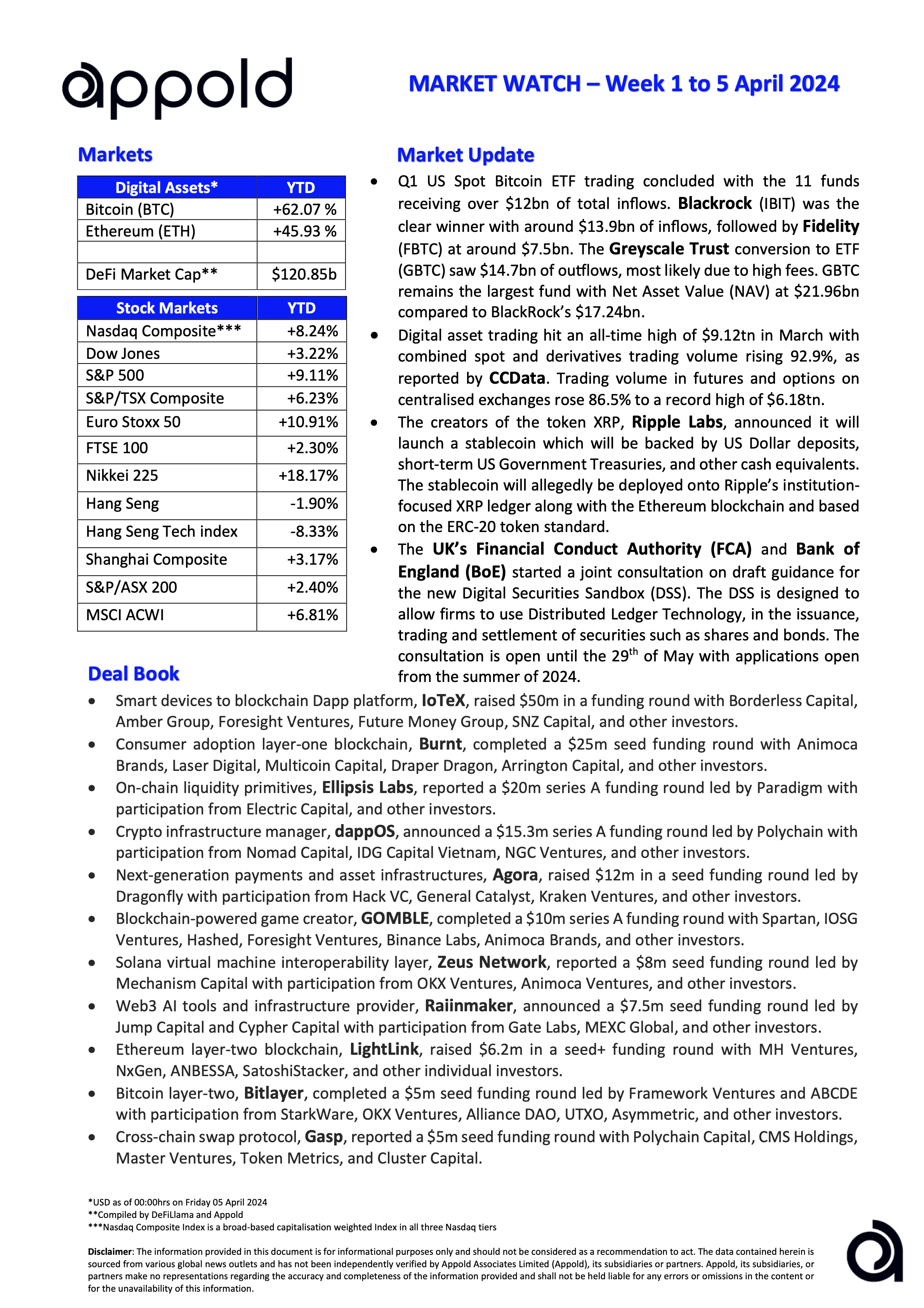

🔷 Q1 US Spot Bitcoin ETF trading concluded with the 11 funds receiving over $12bn of total inflows. BlackRock (IBIT) was the clear winner with around $13.9bn of inflows, followed by Fidelity Investments (FBTC) at around $7.5bn. The Greyscale Bitcoin trust conversion to ETF (GBTC) saw $14.7bn of outflows, most likely due to high fees. GBTC remains the largest fund with Net Asset Value (NAV) at $21.96bn compared to BlackRocks $17.24bn.

Appold view: Big numbers for new ETF issuances in such a small amount of time. Greyscale Trust was around $24bn in AUM when it converted to an ETF and is haemorrhaging funds with its eye-watering fees, AUM staying strong purely by the appreciation in BTC valuations. At this rate, IBIT should overtake it over the coming months, unless it can amend its fee structure.

🔷 Digital asset trading hit an all-time high of $9.12tn in March with combined spot and derivatives trading volume rising 92.9%, as reported by CCData. Trading volume in futures and options tied to crypto on centralised exchanges rose 86.5% to a record high of $6.18tn.

Appold view: Despite being a record month in traded volumes for derivatives, its overall share of total market activity actually fell. This was due to Spot trading volumes jumping 108% in March. Note that the Bitcoin halving is set to occur in less than two weeks, with institutional investors and other market participants adjusting their portfolio allocations accordingly.

🔷 The creators of the token XRP, Ripple Labs, announced it will launch a stablecoin which will be backed by US Dollar deposits, short-term US Government Treasuries, and other cash equivalents. The stablecoin will allegedly be deployed onto Ripple’s institution-focused XRP ledger along with the Ethereum blockchain and based on the ERC-20 token standard.

Appold view: There are mixed views on this, with some potential concerns around liquidity when compared to Tether's (USDT) market dominance, along with potential cost concerns from transaction fees on the Ethereum (ETH) blockchain. On a separate note, Ripple has been in conflict with the SEC, despite some partial wins, in regards to institutional sales of XRP violating securities laws.

🔷 The UK’s Financial Conduct Authority (FCA) and Bank of England (BoE) started a joint consultation on draft guidance for the new Digital Securities Sandbox (DSS). The DSS is designed to allow firms to use Distributed Ledger Technology, in the issuance, trading and settlement of securities such as shares and bonds. The consultation is open until the 29th of May with applications open from the summer of 2024.

Appold view: A step in the right direction, but will most likely be an overly complicated and inefficient process.

#Marketwatch #Blockchain #Investments