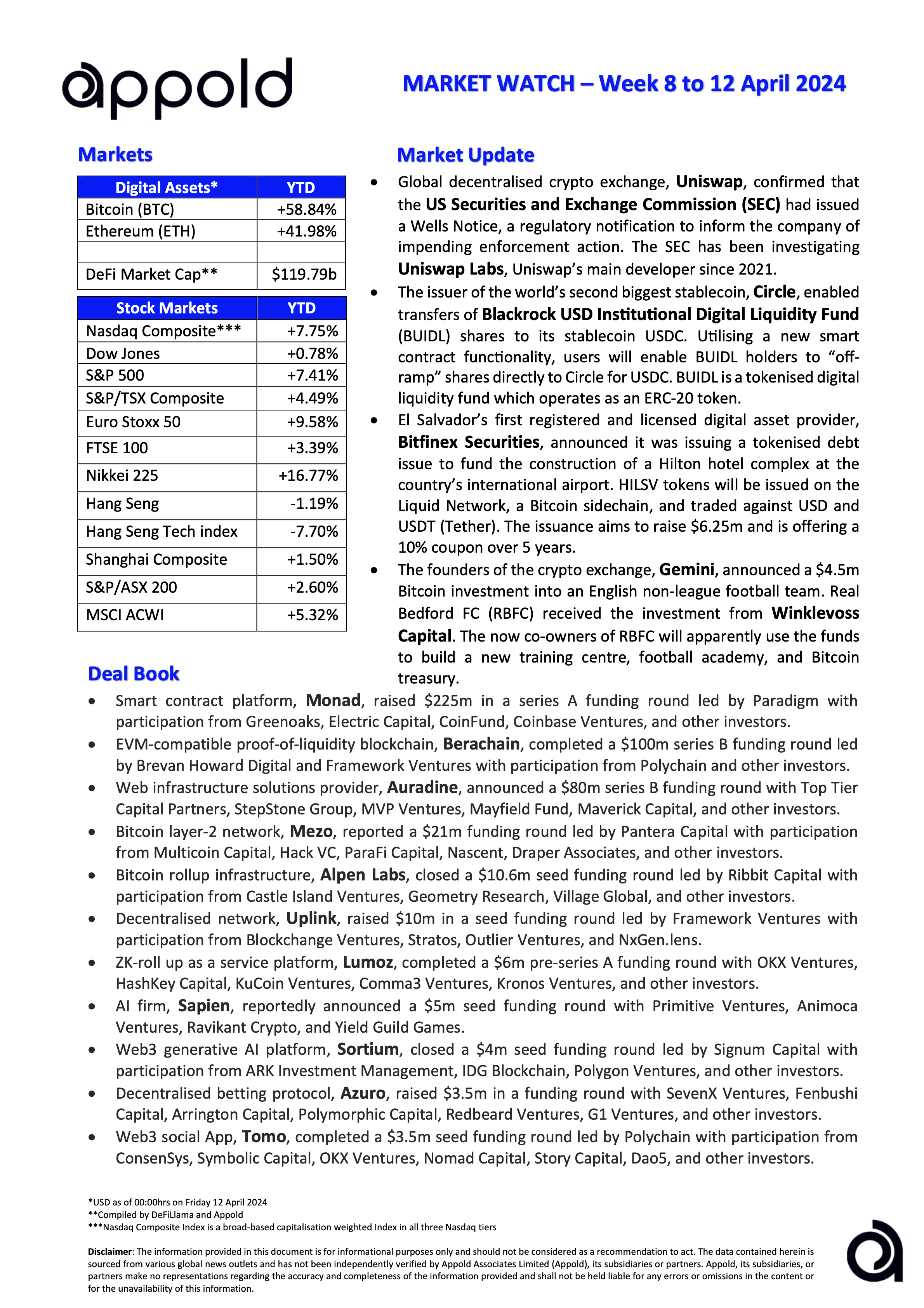

Appold Market Watch - Week 8 to 12 April 2024

Market Update & Industry News - Week ending 12 April 2024

🔷 Global decentralised crypto exchange, Uniswap, confirmed that the U.S. Securities and Exchange Commission Commission (SEC) had issued a Wells Notice, a regulatory notification to inform the company of impending enforcement action. The SEC has been investigating Uniswap Labs, Uniswap’s main developer since 2021.

Appold view: Whether this is a new battlefront against DeFi exchanges or just against Uniswap is unclear at present. Such a notice typically outlines the violations or potential violations that the SEC believes have occurred, providing the recipient with an opportunity to respond and present their case. All will be revealed in due course.

🔷 The issuer of the world’s second biggest stablecoin, Circle, enabled transfers of BlackRock USD Institutional Digital Liquidity Fund (BUIDL) shares to its stablecoin USDC. Utilising a new smart contract functionality, users will enable BUIDL holders to “off-ramp” shares directly to Circle for USDC. BUIDL is a tokenised digital liquidity fund which operates as an ERC-20 token.

Appold view: This development should enhance liquidity and accessibility for investors while continuing the convergence of traditional finance and digital assets. Maybe one day Tether (USDT) can be enabled to boost the liquidity opportunity.

🔷 El Salvador’s first registered and licensed digital asset provider, Bitfinex Securities, announced it was issuing a tokenised debt issue to fund the construction of a Hilton hotel complex at the country’s international airport. HILSV tokens will be issued on the Liquid Network, a Bitcoin sidechain, and traded against the USD and USDT (Tether). The issuance aims to raise $6.25m and is offering a 10% coupon over 5 years

Appold view: A small value but a good test case, with a strong yield. Unlikely to be the senior debt tranche, but somewhere between subordinated and unsecured. Nonetheless, a good test case using a big global hotel brand.

🔷 The founders of the crypto exchange, Gemini, announced a $4.5m Bitcoin investment into an English non-league football team. Real Bedford FC (RBFC) received the investment from Winklevoss Capital. The now co-owners of RBFC will apparently use the funds to build a new training centre, football academy, and Bitcoin treasury.

Appold view: A unique investment and significant size for a non-league football team. Maybe a TV documentary and league promotion are in the pipeline? All good for Gemini branding and PR purposes.

#Marketwatch #Blockchain #Investments