Appold Market Watch - Week 15 to 19 April 2024

Market Update & Industry News - Week ending 19 April 2024

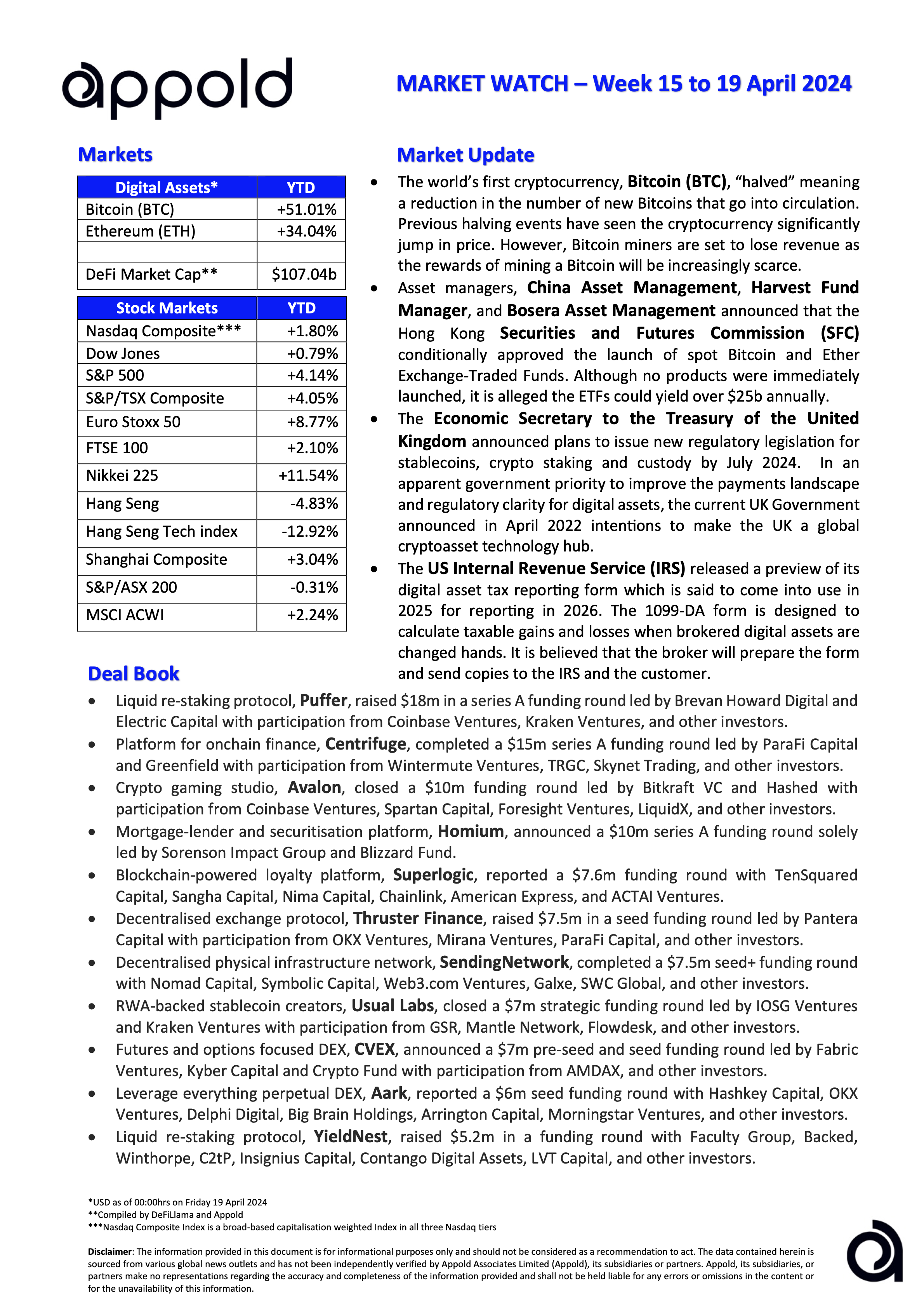

🔷 The world’s first cryptocurrency, Bitcoin (BTC), “halved” meaning a reduction in the number of new Bitcoins that go into circulation. Previous halving events have seen the cryptocurrency significantly jump in price. However, Bitcoin miners are set to lose revenue as the rewards of mining a Bitcoin will be increasingly scarce.

Appold view: We have observed strong upward price pressure this year, through the impact of ETFs and this imminent halving. With a heavily reduced BTC output, we may see some miners consolidate, particularly where their costs of operations no longer compensate for the lower rewards.

🔷 Asset managers, China Asset Management (Hong Kong), Harvest Fund Management and Bosera Asset Management Co. announced that the Hong Kong Securities and Futures Commission (SFC) conditionally approved the launch of spot Bitcoin and Ether Exchange-Traded Funds. Although no products were immediately launched, it is alleged the ETFs could yield over $25b annually.

Appold view: Hong Kong has pivoted in the last few years in its approach to digital assets, by embracing structured regulatory frameworks and improving regional sector innovation. But don’t expect mainland Chinese stock exchanges to be allowed to list these ETFs, or for mainland residents to have access to them, anytime soon.

🔷 The Economic Secretary to the HM Treasury of the United Kingdom announced plans to issue new regulatory legislation for stablecoins, crypto staking and custody by July 2024. In an apparent government priority to improve the payments landscape and regulatory clarity for digital assets, the current UK Government announced in April 2022 intentions to make the UK a global cryptoasset technology hub.

Appold view: Good to see progress on this. In comparison to their EU counterparts, the UK is ahead in terms of providing a faster route to clarity on stablecoin regulation, crypto staking and custody services. Whereas the EU’s broader and uniform approach with MiCA provides a more comprehensive framework and addresses a wider array of digital assets, including stronger cross-border operability. All a step in the right direction.

🔷 The US Internal Revenue Service (IRS) released a preview of its digital asset tax reporting form which is said to come into use in 2025 for reporting in 2026. The 1099-DA form is designed to calculate taxable gains and losses when brokered digital assets are changed hands. It is believed that the broker will prepare the form and send copies to the IRS and the customer.

Appold view: By mandating the use of this form, the IRS places significant responsibility on brokers to ensure tax compliance when dealing with digital assets. This should improve the accuracy of tax reporting but will inevitably increase costs and complexities for the brokers involved.

#Marketwatch #Blockchain #Investments