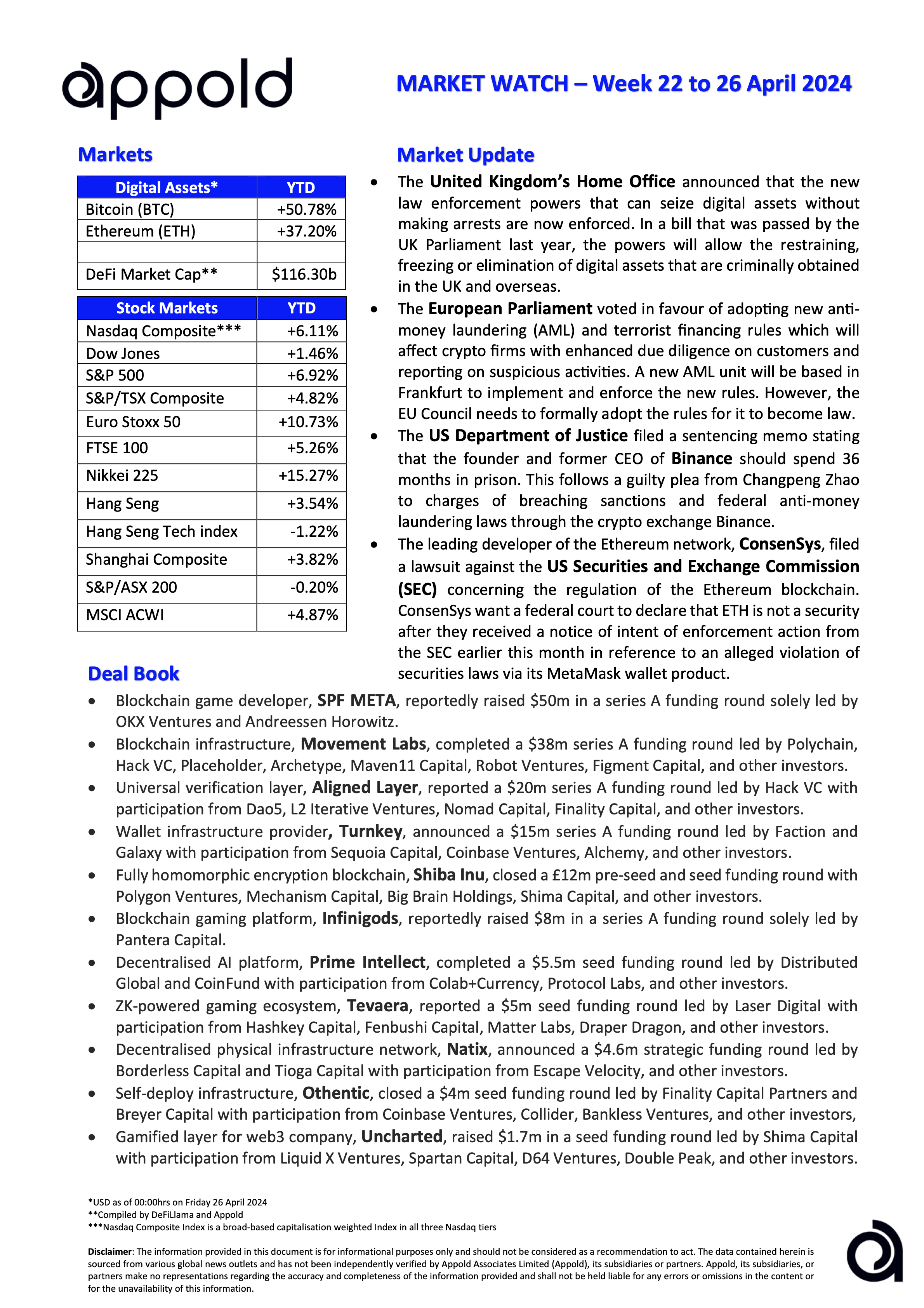

Appold Market Watch - Week 22 to 26 April 2024

Market Update & Industry News - Week ending 26 April 2024

🔷 The UK Home Office announced that the new law enforcement powers that can seize digital assets without making arrests are now enforced. In a bill that was passed by the UK Parliament last year, the powers will allow the restraining, freezing or elimination of digital assets that are criminally obtained in the UK and overseas.

Appold view: A welcome law aimed at enhancing the security and legitimacy of digital asset transactions. For further details and deeper insights, please refer to our analysis of this when it was first announced in November- https://www.appold.com/news/new-uk-legislation-seize-digital-assets

🔷 The European Parliament voted in favour of adopting new anti-money laundering (AML) and terrorist financing rules which will affect crypto firms with enhanced due diligence on customers and reporting on suspicious activities. A new AML unit will be based in Frankfurt to implement and enforce the new rules. However, the EU Council needs to formally adopt the rules for it to become law.

Appold view: We think this is positive but some perceive the regulations as stringent, with crypto firms having to undertake due diligence on their customers to a level similar to traditional financial institutions. Either way, this could take anywhere between a few months and a couple of years to be fully implemented across all EU member states.

🔷 The U.S. Department of Justice filed a sentencing memo stating that the founder and former CEO of Binance should spend 36 months in prison. This follows a guilty plea from Changpeng Zhao to charges of breaching sanctions and federal anti-money laundering laws through the crypto exchange Binance.

Appold view: This recommendation is reported to exceed the usual federal guidelines for such violations, typically around 10-16 months. Zhao already faces a financial penalty of $50m and Binance $4.3bn. Huge figures, but in the bigger picture, probably a fraction of what has been made by them to date.

🔷 The leading developer of the Ethereum network, Consensys, filed a lawsuit against the U.S. Securities and Exchange Commission (SEC) concerning the regulation of the Ethereum blockchain. ConsenSys want a federal court to declare that ETH is not a security after they received a notice of intent of enforcement action from the SEC earlier this month in reference to an alleged violation of securities laws via its MetaMask wallet product.

Appold view: The Consensys lawsuit highlights the frustrations around the classification and regulation of these digital assets. Regulatory clarity aids market maturity and allows clear strategic roadmaps to be built without fear of being on the wrong side of the law. The SEC won’t like being sued and could, if feeling vindictive, potentially delay other areas of ETH progression such as the potential ETH spot ETF approvals. Time will tell.

#Marketwatch #Blockchain #Investments