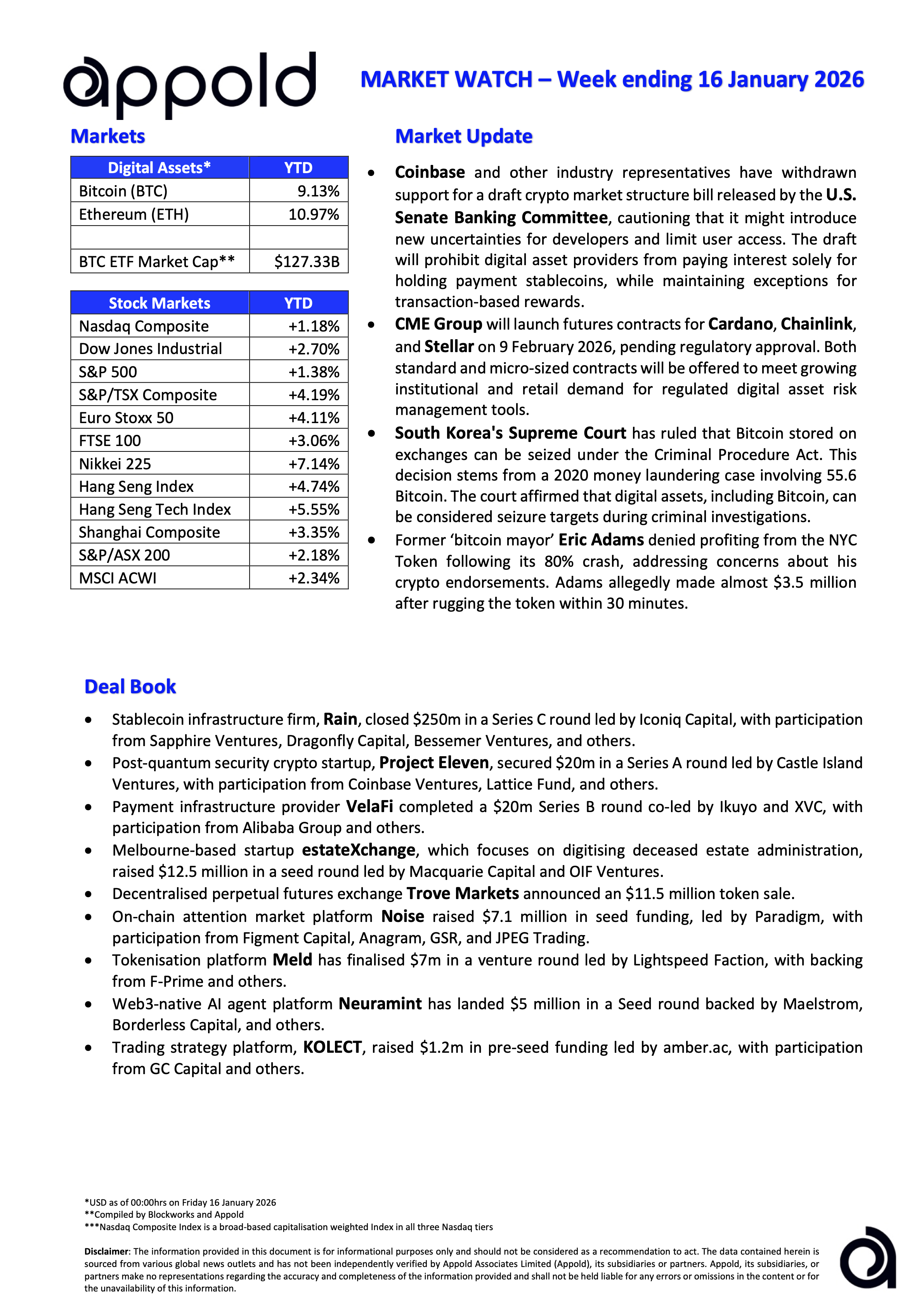

Appold Market Watch - Week ending 16 January 2026

Market Update & Industry News - Week ending 16 January 2026

🔷 Coinbase and other industry representatives have withdrawn support for a draft crypto market structure bill released by the U.S. Senate Banking Committee, cautioning that it might introduce new uncertainties for developers and limit user access. The draft will prohibit digital asset providers from paying interest solely for holding payment stablecoins, while maintaining exceptions for transaction-based rewards.

Appold's view: While the delay to the Clarity Act comes as no surprise, these final points risk becoming non-negotiable if the Senate and industry representatives fail to align on a clear path forward. Hopefully, this outcome can still be avoided.

🔷 CME Group will launch futures contracts for Cardano, Chainlink, and Stellar on 9 February 2026, pending regulatory approval. Both standard and micro-sized contracts will be offered to meet growing institutional and retail demand for regulated digital asset risk management tools.

Appold's view: Possibly demand-driven but certainly a cautious extension of its crypto derivatives offering, prioritising assets with liquidity and regulatory comfort, rather than any directional endorsement of the underlying protocols.

🔷 South Korea's Supreme Court has ruled that Bitcoin stored on exchanges can be seized under the Criminal Procedure Act. This decision stems from a 2020 money laundering case involving 55.6 Bitcoin. The court affirmed that digital assets, including Bitcoin, can be considered seizure targets during criminal investigations.

Appold's view: While not unexpected, this announcement may prompt many more users to move assets into cold storage. However, any form of legal recognition of digital assets remains a positive development in court for future development.

🔷 Former "bitcoin mayor" Eric Adams denied profiting from the NYC Token following its 80% crash, addressing concerns about his crypto endorsements. Adams allegedly made almost $3.5 million after "rug-pulling" the token within 30 minutes.

Appold's view: NYC Token demonstrates how civic branding and political endorsement can attract rapid liquidity, but the absence of transparent governance has undermined credibility, turning a potentially constructive initiative into one now overshadowed by "rug-pull" allegations.

#Marketwatch #Blockchain #Investments