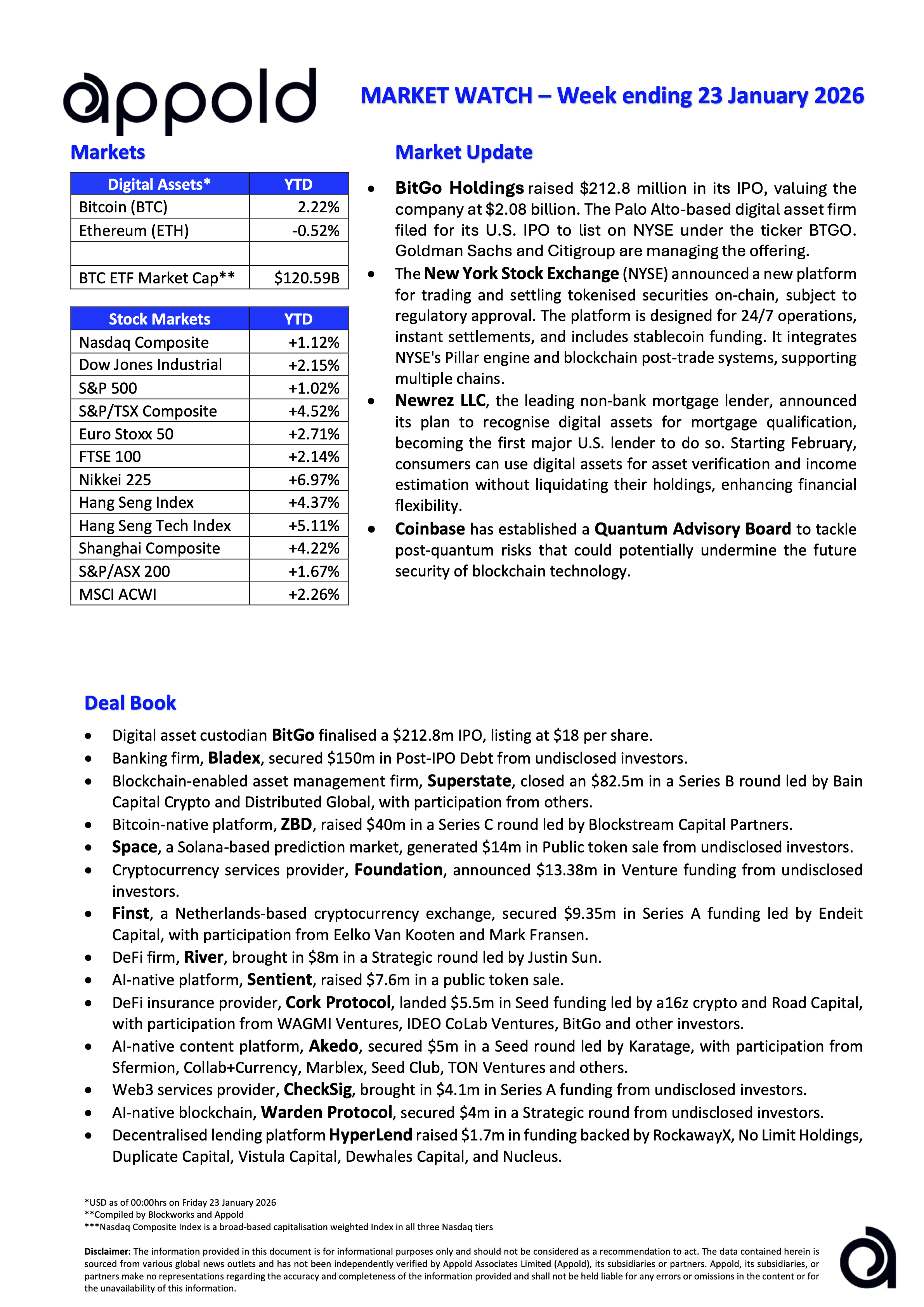

Appold Market Watch - Week ending 23 January 2026

Market Update & Industry News - Week ending 23 January 2026

🔷 BitGo Holdings raised $212.8 million in its IPO, valuing the company at $2.08 billion. The Palo Alto-based digital asset firm filed for its U.S. IPO, which will list on NYSE under the ticker BTGO. Goldman Sachs and Citi are managing the offering.

Appold View: BitGo’s IPO marks a further institutionalisation of digital asset infrastructure, with public market investors increasingly comfortable backing regulated custody and infrastructure providers rather than directional crypto exposure.

🔷 The New York Stock Exchange (NYSE) announced a new platform for trading and settling tokenised securities on-chain, subject to regulatory approval. The platform is designed for 24/7 operations, instant settlements, and includes stablecoin funding. It integrates NYSE's Pillar engine and blockchain post-trade systems, supporting multiple unnamed chains.

Appold View: While 24/7 trading remains constrained by sizeable liquidity and market-maker participation, as seen on venues like Kraken and eToro, the NYSE’s public positioning is significant. It signals acceptance that legacy market structures are under pressure from new blockchain technology and is likely to accelerate similar moves across other major exchanges.

🔷 Newrez LLC, the leading non-bank mortgage lender, announced its plan to recognise digital assets for mortgage qualification, becoming the first major U.S. lender to do so. Starting in February, consumers can use digital assets for asset verification and income estimation without liquidating their holdings, enhancing financial flexibility

Appold View: Real-world utility is what ultimately drives crypto adoption. Announcements like this matter because they move the conversation away from speculation and toward practical use cases.

🔷 Coinbase has established a Quantum Advisory Board to tackle post-quantum risks that could potentially undermine the future security of blockchain technology.

Appold View: Quantum security is not just a digital-asset issue, it is a systemic risk to global security infrastructure. Boards like this play an essential role by advancing open-source research and practical frameworks, helping organisations prepare for a post-quantum encryption world.

#Marketwatch #Blockchain #Investments