Appold Market Watch - Week ending 30 January 2026

Market Update & Industry News - Week ending 30 January 2026

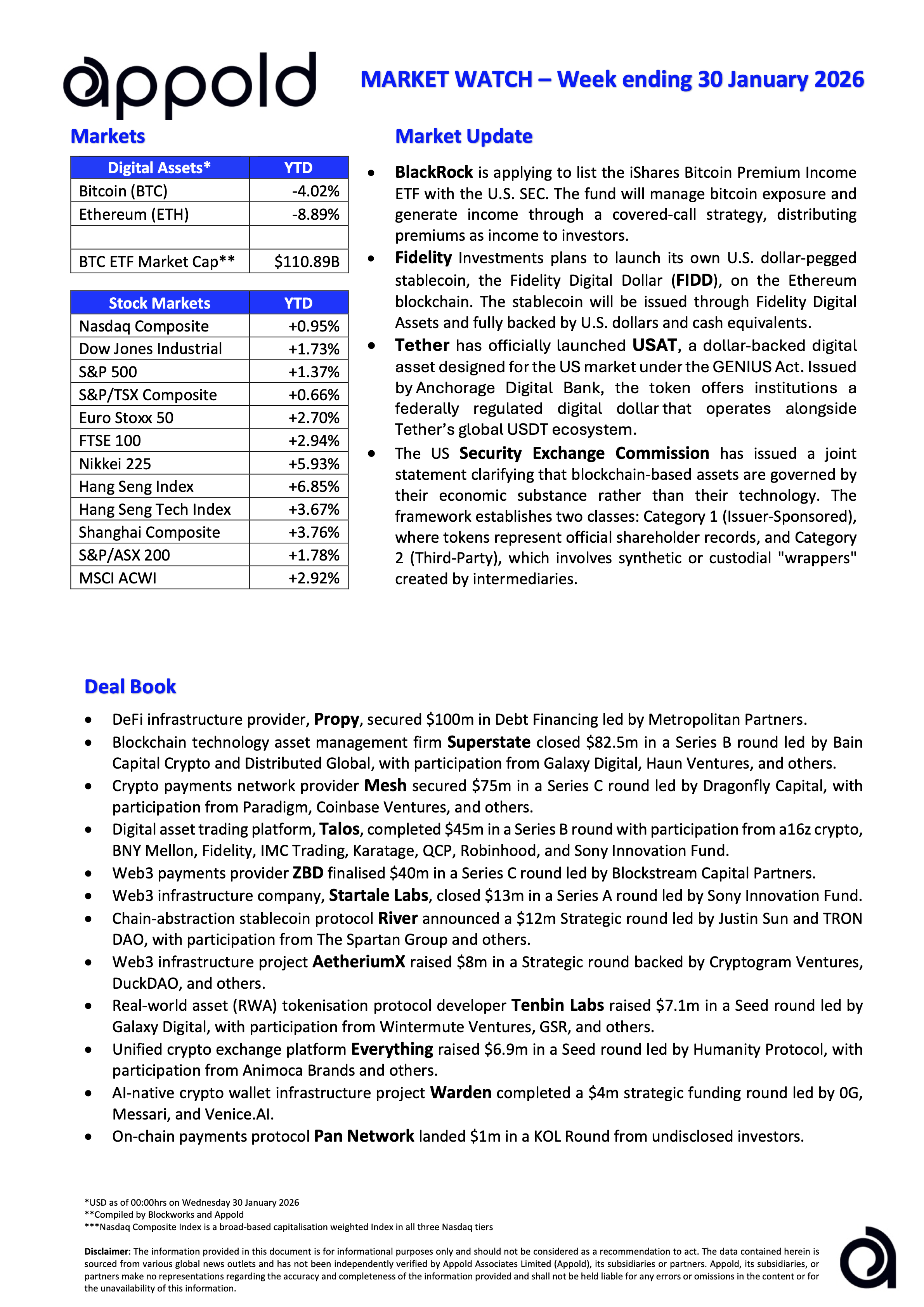

🔷 BlackRock is applying to list the iShares Bitcoin Premium Income ETF with the U.S. SEC. The fund will manage bitcoin exposure and generate income through a covered-call strategy, distributing premiums as income to investors.

Appold View: This strategy broadens Bitcoin’s appeal to wealth managers and institutions constrained by pure directional exposure, highlighting the focus from speculative positioning towards structured, governance-friendly risk-return profiles. This highlights the maturing of digital asset capital markets, as traditional portfolio tools are increasingly applied to crypto-native assets.

🔷 Fidelity Investments plans to launch its own U.S. dollar-pegged stablecoin, the Fidelity Digital Dollar (FIDD), on the Ethereum blockchain. The stablecoin will be issued through Fidelity Digital Assets and fully backed by U.S. dollars and cash equivalents.

Appold View: It makes commercial sense for financial institutions to issue their own stablecoins and reap the commercial benefits; however, there could be a risk of market share saturation in the short term due to non-interoperable ecosystems. This will need to be addressed.

🔷 Tether.io has officially launched USAT, a dollar-backed digital asset designed for the US market under the GENIUS Act. Issued by Anchorage Digital Bank, the token offers institutions a federally regulated digital dollar that operates alongside Tether’s global USDT ecosystem.

Appold View: By positioning as a federally regulated alternative to USDT, it enables institutions wary of potential regulatory and governance risks associated with Tether to utilise it, whilst further competing with Circle’s USDC. Now they need liquidity and institutional adoption to avoid the fate of many failed stablecoins.

🔷 The US Security Exchange Commission has issued a joint statement clarifying that blockchain-based assets are governed by their economic substance rather than their technology. The framework establishes two classes: Category 1 (Issuer-Sponsored), where tokens represent official shareholder records, and Category 2 (Third-Party), which involves synthetic or custodial "wrappers" created by intermediaries.

Appold View: The SEC’s taxonomy effectively creates a regulatory ceiling for many crypto-native assets. By categorising third-party synthetic tokens, common in DeFi, as Category 2, the Commission may prohibit sales to retail investors unless the tokens are registered and traded on a national exchange. This framework may likely restrict a broad swath of existing "wrapped" tokens to institutional-only markets, potentially slowing the retail-driven liquidity that many decentralised protocols rely on to function.

#Marketwatch #Blockchain #Investments