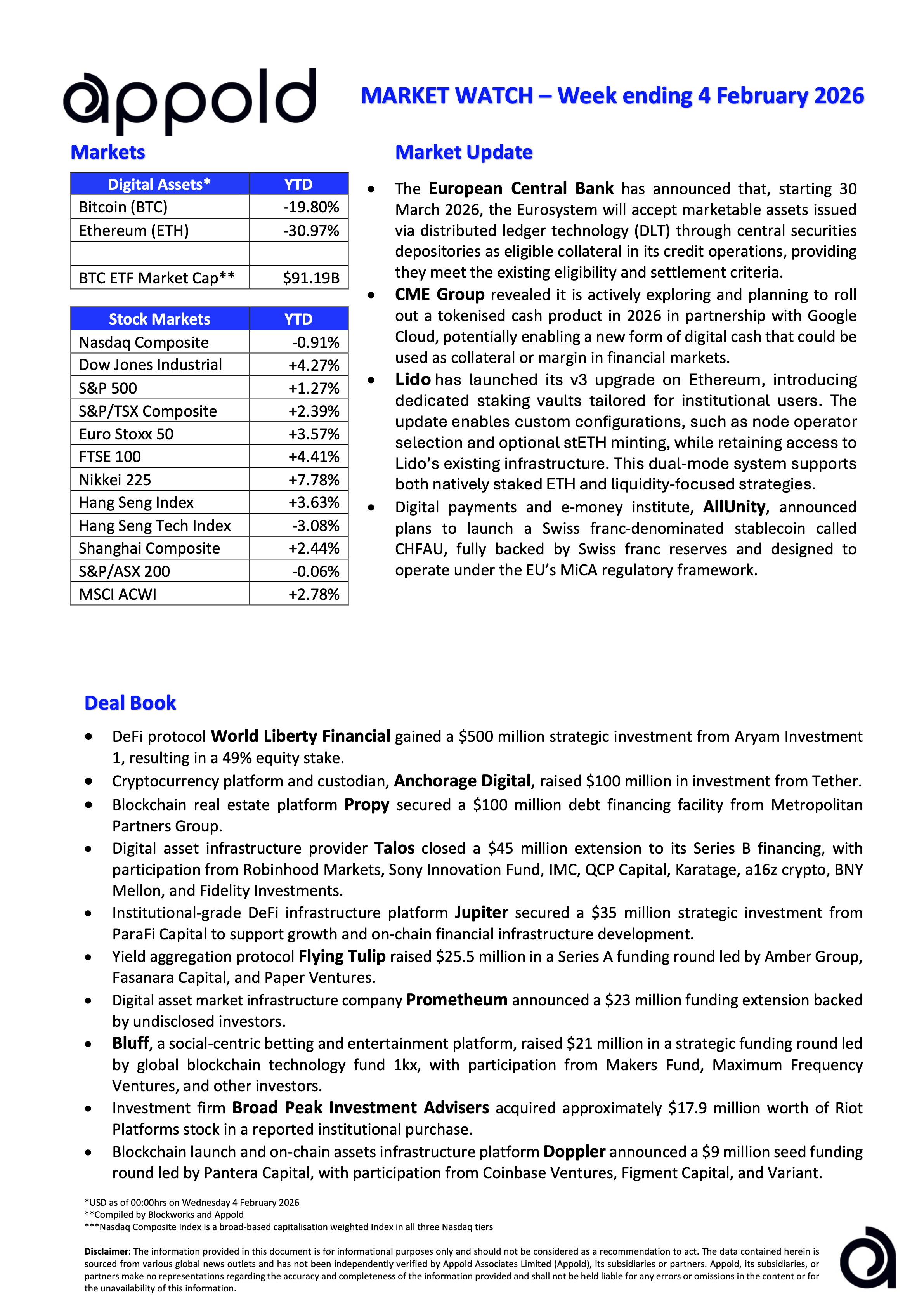

Appold Market Watch - Week ending 4 February 2026

Market Update & Industry News - Week ending 4 February 2026

🔷 The European Central Bank has announced that, starting 30 March 2026, the Eurosystem will accept marketable assets issued via distributed ledger technology (DLT) through central securities depositories as eligible collateral in its credit operations, providing they meet the existing eligibility and settlement criteria.

Appold view: The ECB has also announced that it has begun research into potentially expanding its accepted security systems. This is a great example of the power blockchain has. The ECB has slightly expanded its reach while simultaneously researching whether its current rules still apply in a modern age.

🔷 CME Group revealed it is actively exploring and planning to roll out a tokenised cash product in 2026 in partnership with Google Cloud, potentially enabling a new form of digital cash that could be used as collateral or margin in financial markets.

Appold view: The CME’s move towards tokenised cash should elevate the profile of blockchain-enabled collateral within traditional finance, while helping future-proof the exchange against neo-exchange competition. How CME structures its offering, with control over permissions, issuer or chains, will likely send strong signals to the industry, particularly competitors weighing up their own crypto strategies.

🔷 Lido has launched its v3 upgrade on Ethereum, introducing dedicated staking vaults tailored for institutional users. The update enables custom configurations, such as node operator selection and optional stETH minting, while retaining access to Lido’s existing infrastructure. This dual-mode system supports both natively staked ETH and liquidity-focused strategies.

Appold view: Lido is positioning itself to meet growing demand from ETFs, digital asset treasuries, and institutional investors. This upgrade focuses on a key institutional requirement: flexibility. By allowing greater customisation around jurisdictional considerations, risk profiles, and use cases, Lido is moving closer to institutional-grade infrastructure. This is a strong and pragmatic step forward, one that other native blockchain companies could learn from as they seek broader adoption.

🔷 Digital payments and e-money institute, AllUnity, announced plans to launch a Swiss franc-denominated stablecoin called CHFAU, fully backed by Swiss franc reserves and designed to operate under the EU’s MiCA regulatory framework.

Appold view: The US dollar's dominance in on-chain transactions is undeniable, but we expect more countries and institutions to launch their own stablecoins in due course. Nonetheless, this action should help position the Swiss franc to function natively within programmable payment flows, treasury mobility, and on-chain settlement architecture rather than at the periphery of stablecoin markets.

#Marketwatch #Blockchain #Investments