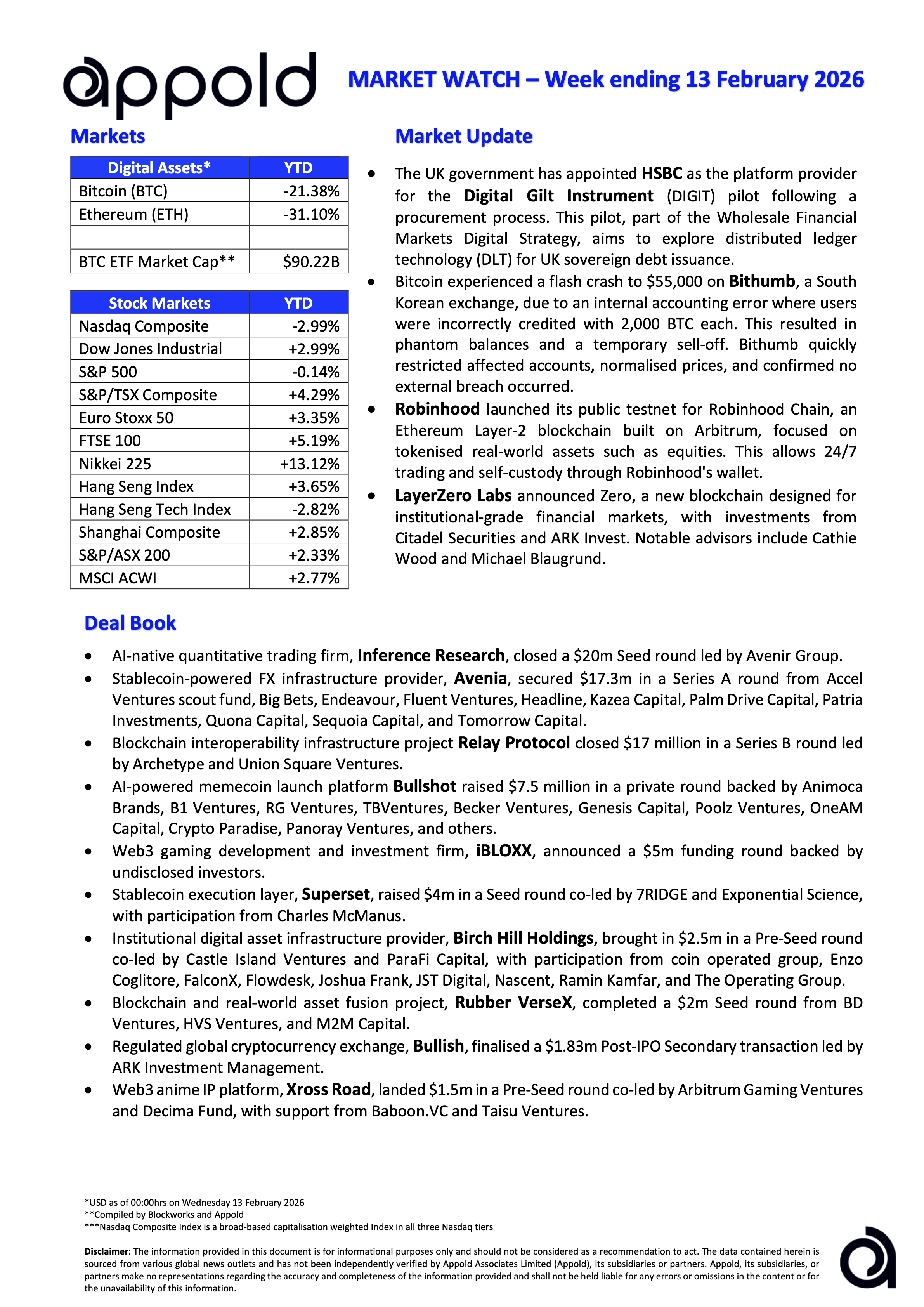

Appold Market Watch - Week ending 13 February 2026

Market Update & Industry News - Week ending 13 February 2026

🔷 The UK government has appointed HSBC as the platform provider for the Digital Gilt Instrument (DIGIT) pilot following a procurement process. This pilot, part of the Wholesale Financial Markets Digital Strategy, aims to explore distributed ledger technology (DLT) for UK sovereign debt issuance.

Appold View: HSBC followed a formal procurement process, assessing a number of factors around DLT infrastructure and integration into existing systems. The choice seems reasonable given that HSBC already operates a digital bond issuance platform (Orion) and has participated in multiple sovereign and supranational DLT bond pilots. But despite these announcements, the UK continues to lag behind other jurisdictions on digital asset regulation, hindering innovation.

🔷 Bitcoin experienced a flash crash to $55,000 on bithumb official, a South Korean exchange, due to an internal accounting error where users were incorrectly credited with 2,000 BTC each. This resulted in phantom balances and a temporary sell-off. Bithumb quickly restricted affected accounts, normalised prices, and confirmed no external breach occurred.

Appold View: Digital asset-related services now have institutional volumes flowing through their systems; however, many lack the operationally resilient, risk-managed procedures that incumbent companies have developed over the years. While often seen as the less glamorous side of business, these functions are extremely valuable. Stories such as Bithumb will continue to highlight this issue.

🔷 Robinhood launched its public testnet for Robinhood Chain, an Ethereum Layer-2 blockchain built on Arbitrum, focused on tokenised real-world assets such as equities. This allows 24/7 trading and self-custody through Robinhood's wallet.

🔷 LayerZero Labs announced Zero, a new blockchain designed for institutional-grade financial markets, with investments from Citadel Securities and ARK Invest. Notable advisors include Cathie Wood and Michael Blaugrund.

Appold View: These recent announcements highlight a clear split in blockchain development. Platforms like Robinhood are focusing on real-world assets, retail usability, and access to DeFi liquidity, while infrastructure providers such as LayerZero are positioning themselves as institutional-grade rails.

The fact that LayerZero will be supporting the Robinhood chain reinforces the direction of travel: rather than a single dominant chain, the market will evolve towards a stack of complementary chains and systems, each optimised for a specific function.

The key question now is not whether this segmentation will occur, but how these layers mature, where the boundaries between them are drawn, and which players ultimately capture the most value within this evolving architecture.

#Marketwatch #Blockchain #Investments